They fear the continuous rise will take a significant toll on Hyundai Motor and Kia in Europe and other global markets in the coming years.

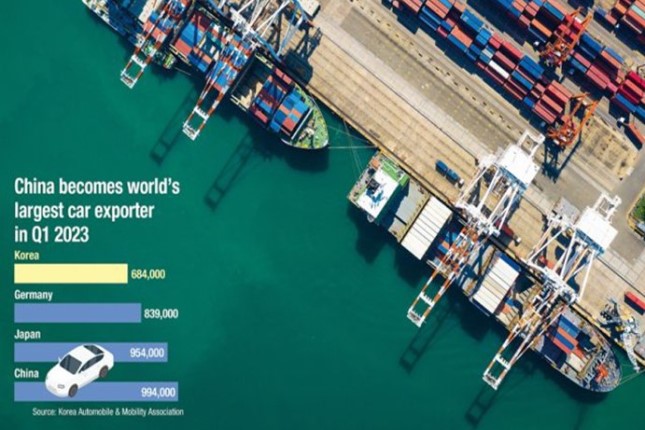

According to the Korea Automobile Manufacturers Association (KAMA), China became the world's top automobile exporter for the first quarter of this year. China surpassed Japan, exporting 994,000 vehicles, while Japan exported 954,000 vehicles during the same period. China's automobile exports consisted of 826,000 passenger cars and 168,000 commercial vehicles, including buses and trucks. Approximately 80 percent of China's export volume comprises pure Chinese brand products.

"Last year, China became the second-largest exporter and this year, in April, it became the largest. Although China will continue to grow its domestic market, ultimately, to solve the supply and demand issue, it has no choice but to expand into the export market as the local market is already saturated. That's why they made this declaration and embarked on an export drive," Lee Hang-koo of the Korea Automotive Technology Institute said. "Hyundai focused on emerging markets and experienced growth but recently the Chinese market fell through. The U.S. market is doing well, however, we are already slightly falling behind in the European market."

China's successful diversification export strategy is attributed to the surge in the country's automobile exports. In 2016, Iran, India, Vietnam and the U.S. were the top export destinations for Chinese cars. However, Belgium, Chile, Australia and the United Kingdom became the leading export markets last year with around 20 percent of China's exports being directed to Europe.

"Global automotive market is expected to experience fluctuations due to the increase in exports of Chinese vehicles. There is a cautious approach towards this trend and efforts will be made to enhance customer satisfaction through various methods such as quality improvement and marketing differentiation," an official at a major local carmaker said.

China is moving away from primarily exporting low-cost vehicles, with the average export price per Chinese car increasing from $12,900 in 2018 to $16,400 in 2022, a 27 percent rise. The average price is expected to surpass $20,000 this year.

"China continues to push both electric and internal combustion engine vehicles out into the export market, leaving South Korean companies at a disadvantage. Hyundai has the Genesis brand, which is a luxury car brand, but in the end, the company needs to compete with both internal combustion engine vehicles and EVs in the mid-to-low price range," Lee said.

Foreign-owned car companies investing in China also contribute to increased exports. Tesla, Mercedes-Benz and Volvo, with factories in China, actively engage in exports. Tesla ranked third among Chinese car companies in terms of exports, producing and exporting 270,000 vehicles in China last year.

The China Automobile Dealers Association (CADA) stated in its recent report that "Chinese companies with relatively robust supply chains seized the opportunity during the semiconductor shortage, which contributed to the improvement in export performance."

China's expansion of automobile exports is just the beginning, as Chinese companies aggressively enter the global market, particularly in Europe, leveraging their competitiveness in future cars, such as EVs.

China is the world's top automobile producer, manufacturing 27 million vehicles last year. Until about a decade ago, China focused primarily on meeting overflowing domestic demand and did not make significant efforts in exports. However, around six years ago, as the domestic market approached saturation, the government actively encouraged companies to enter the global market.

One notable example is BYD. The company, specializing in EVs, increased its global sales by 93 percent in the first quarter of this year, selling 552,076 vehicles compared to the same period last year. Sales are expected to increase once their compact electric car model Xige is launched in the European market at the end of the year.

Shanghai Automotive Industry Corporation (SAIC) and Chery Automobile, China's top two automobile exporters, are also proactive in the field of environmentally friendly vehicles, not only with conventional internal combustion engine sedans, buses and vans, which are their main products. Global credit rating agency Fitch has forecasted that China's market share in the European EV market will increase from 5 percent in 2023 to 15 percent in 2025.

Source: The Global Times.