Across eastern Europe, the financial toll of Vladimir Putin’s 14-month-old war on Ukraine is piling up. Energy subsidies are being doled out, armies built up and refugees housed, schooled and fed.

To help pay those bills, Ukraine’s neighbors are tapping international debt markets like never before.

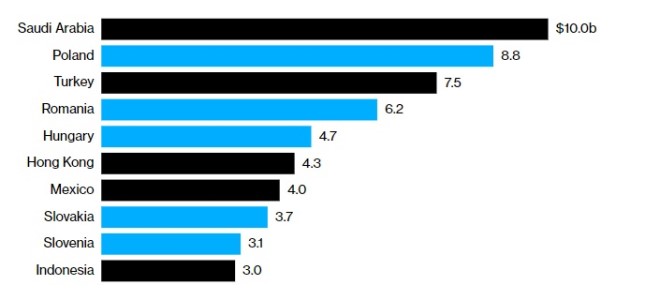

Governments in eastern Europe have borrowed nearly $32 billion already this year, triple the amount from the same period last year, according to data compiled by Bloomberg. And for the first time in a dozen years, three eastern European countries — Poland ($9 billion), Romania ($6 billion) and Hungary ($5 billion) — register among the top five emerging-market borrowers in overseas markets.

Eastern Europe Dominates EM in Government Debt Sales

Volume of FX debt issuance by governments in 2023

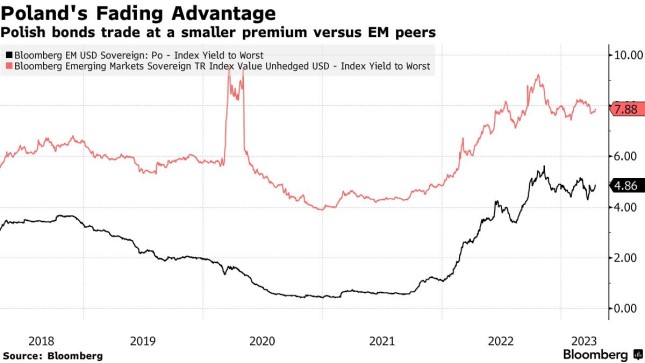

The timing’s not great. It’s become a lot more expensive to borrow in bond markets — even for highly rated governments like those in eastern Europe — after central banks across the globe rapidly raised interest rates this past year. Poland, for instance, is paying 5.5% in annual interest on a new 30-year bond. Back in 2021, that same bond would have sold for less than 4%.

This growing interest tab will only add to the region’s suddenly swelling budget deficits and heap more pressure on finance officials. What’s more, if Russia’s invasion of Ukraine drags on or intensifies, and even greater debt-funded spending is required across the region, foreign investors may not be as willing to soak up the additional bonds flooding into the market.

There are signs that investors already are becoming a little reluctant. Poland’s dollar bonds are now trading at yields similar to those of countries long deemed to be riskier: the Philippines, Indonesia and Uruguay.

Sergey Dergachev, head of emerging-market corporate debt at Union Investment Privatfonds GmbH in Frankfurt, says he can’t detect any extra cost being tacked onto the region’s bonds by investors so far. But, he says, “the situation is very much dependent” on hard-to-predict things such as developments on the ground in Ukraine, which means a deterioration in financing conditions “can’t be be discounted, unfortunately.”

Ballooning Deficits

Eastern Europe’s budget deficit will balloon to 4.3% of the region’s gross domestic product this year, up from 1.3% in 2021, according to analyst estimates on Bloomberg.

“The war hits fiscal deficits from both sides,” said Daniel Wood, a fixed income portfolio manager at William Blair International. “It lowers growth, which reduces revenue collection for the government, and on the expenditure side it has been necessary for governments to help those that have been hit hard by the cost of living.”

The pivot toward overseas debt markets comes as inflation ravages eastern European economies. This, too, was in part triggered by the war, which cut off most Russian energy flows to the region. Inflation’s soared to around 20% in some countries — levels not seen in decades — and in turn has driven local interest rates up even more than they climbed in the US and western Europe. In Poland, the region’s biggest economy, 10-year bonds now yield 6%, four times the level from just two years ago.

But selling foreign bonds raises a key risk that doesn’t exist in the local market. If the region’s currencies start slumping against the dollar, as they have periodically over the years, this will drive up the cost for these governments to repay the debt.

Asked for a comment about the issuance spree, Zoltan Kurali, the head of Hungary’s debt management agency, said that a “capped level” of foreign-currency debt is cheaper than borrowing in forint. Also, it helps to diversify the investor base as “one would not be able to raise all this funding in a single market.”

Poland has scope within its financing plan to borrow abroad and tools to reduce costs if needed, the Finance Ministry in Warsaw said by email. In the longer-term, the zloty should appreciate given the country’s economic fundamentals, helping to reduce the debt load, it added. Romania’s Finance Ministry wasn’t immediately available for comment.

"Element of Refinancing"

Emerging-market sales of sovereign dollar- and euro-bonds fell to $104 billion last year, the least since 2013, data compiled by Bloomberg show. Out of this year’s $32 billion issuance by eastern Europe, only about $14 billion is needed for refinancing.

The sales surge includes an “element of refinancing” as the market opened following a tough 2022, according to Zsolt Papp, a senior investment manager at JPMorgan Asset Management. “It was much more about when is the right moment,” he said. “They haven’t been in the market for a while, so they knew that they could issue at very favorable conditions.”

The early rush to sell foreign bonds this year signals that sales should slow over the rest of the year and acts as a near-term “technical tailwind” for the region’s dollar bonds, said ING Groep NV analysts, including Frantisek Taborski.

ING predicted that Hungary was in a “comfortable” position where it could but didn’t need to tap foreign markets again in 2023, while Poland was ahead of schedule. Romania was likely to need another foreign debt sale this year, ING said last week.

Cathy Hepworth, head of emerging-market debt at PGIM Fixed Income, said she “selectively” likes the region’s bonds. Because these governments have sold a lot of the bonds this year in the US market, instead of the euro market as they usually do, there’s been strong demand from emerging-market investors who benchmark their returns against dollar-denominated bond indexes, she said.

Sovereign debt from eastern Europe has outperformed peers, led by Serbia’s 8.1% return in 2023, Romania’s 5.6%, Hungary’s 4.1% and Poland’s 2.4%. The average return on developing-country debt is 1.4%, according to Bloomberg dollar bond indexes.

Bond Market Clout

The surge in global interest rates is already exerting pressure, though, on governments in Hungary and Poland. Lured by the possibility of unlocking billions of euros in European Union funds, both countries suddenly agreed in December — after years of intransigence — to address concerns about the strength of their democracies. The talks haven’t progressed enough yet to free up the money, prompting the nations to turn to the bond market for the cash.

Read More: Bond Traders Push EU Rebels Into Deals They Long Rejected

Poland’s deterioration comes in an election year — which could fuel more spending. Furthermore, the government is saddled with a growing pile of off-budget public debt, which is set to reach 638 billion zloty ($152 billion) in 2026, according to its own forecasts.

“Fiscal accounts will remain wide this year,” said Nafez Zouk, an emerging-market sovereign debt analyst at Aviva Investors in London. The region is dealing with the war fallout by “subsidizing or transferring funds to households such as energy and price caps. These had a big fiscal cost, and there will still be a hard-currency shortfall to finance as access to EU funds is delayed.”

Photo: The city skyline from the old town district of Warsaw © Damian Lemański / Bloomberg.

Source: Bloomberg.