Living in a turbulent economic environment is stressful, with the stock market and bank system going through bad times, a severe energy crisis striking Europe, and seemingly reliable companies collapsing. It may be high time now to think about the soul and eternal values like art. Jokes aside, economic crises are a good opportunity to invest in art. Mainly when some bankrupt companies get rid of their collections and prices for valuable artworks become lucrative. But it is a matter of extensive discussion whether purchasing art is a good investment and whether its benefits outweigh the risks.

For a long time, art has been a separate world, functioning according to its own very peculiar laws and lifestyle – with bohemian artists, eccentric art curators and frenzied collectors. And this environment may still seem inconvenient for business-minded investors, who are more familiar with offices than art studios. But to become a successful investor in art, one needs to understand this world very well and to pace up to its trends, just like in any other field.

At first glance, it seems easy to get lost in this sphere because the volume of works of art created by humankind throughout its history exceeds all the limits available to the human mind. Indeed, this makes the art market very diverse. These are both old and contemporary artworks, originals and copies (which can also be rare and valuable), antiques (furniture, porcelain, textiles, arts and crafts of all kinds), paintings, drawings, lithographs, photography and a great variety of other techniques. And, of course, the latest talk of the city – NFTs (non-fungible tokens), unique blockchain-certified digital images, and artworks that can be created, bought and sold just like any other piece of art.

In 2021, a digital work, "Everyday: the First 5000 Days", created by American artist Mike Winkelmann, known professionally as Beeple, was sold for $69.3 million, making it the most expensive non-fungible token ever.

NFT breaks the stereotype that the art market is a safe haven for a conservative long-range investor. The art market is increasingly speculative, and its cycles are shortening, meaning investments are risky. The hype around NFT rose in 2020 and peaked in 2021 when it was worth some $3 bln, but at the end of the same year, this newly emerged art market segment already started to collapse (estimated just $350m a year later). In 2022, art NFTs were owned for just over a month on average before being resold (according to UBS's Art Market Report) – the art market sometimes also becomes a playground for speculators.

Pricing at any level of the art market mirrors what is considered established or recognized art. Recognized art fills museums worldwide, and what is bought and sold at exorbitant prices at art auctions like Sotheby's and Christie's, mostly created before the beginning of the 21st century. The more recognized a specific piece of art is, the more it is similar to "blue chips" in the stock market – investment in it is not risky if the artwork is purchased from a credible source, and its authenticity is not questioned. And this is where art historians and experts are brought in to evaluate works of art and offer attribution. The price for such an object is likely to fluctuate with the overall state of the economy and slowly increase without dramatic ups and downs.

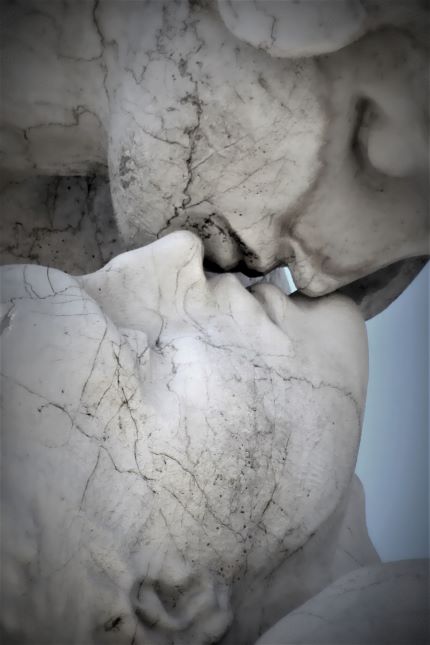

But risks are still there since attribution is often controversial. A prime example is the famous case of the sculpture attributed to Michelangelo, the so-called Fifth Avenue Cupid.

The art historian Kathleen Weil-Garris Brandt discovered the sculpture at the French Embassy in New York. It was publicized by James Draper, who was curator of European sculpture at the Metropolitan Museum, and now forms the museum's collection as the work of the Italian sculptor, although there is much evidence against its attribution to Michelangelo.

This is precisely the case when the price for a piece of marble previously considered nice, but second-rate art overnight rose to a six-digit number (by comparison, in May 2022, a newly discovered Michelangelo small piece, a drawing was sold for $21 million at Christie's auction).

When buying art, the two main pillars are the name of the artist and the intelligible history of the artwork, including its purchase history. Every old piece has its purchasing history, often making the piece more expensive than other works by the same prominent artist. Of course, this game is all about uniqueness: the artwork should be original and have a special aura of a master touch. You can buy at almost any museum a cheaper machine-made version of the called initially giclée, but still, it remains only a copy.

However, "blue chips" in the art market cost millions and are way too expensive for the middle class. Purchasing some rising star of contemporary art is much more affordable and may bring larger profits, but in this case, the buyer is taking huge risks.

If you are not a professional in the art market and just put an eye on some art piece at a gallery or some cruise art auction, buy what you like and don't think of it as an investment. It will bring you great joy, hanging on the wall in your living room. But if you think of your future purchase as an investment, you better research first and consult a specialist in the field. If you don't live in a world of art and don't follow its trends, you still can make suitable long-time investments, but don't even try to "pump and dump" to buy and resell quickly.

Instead, it's worth discovering some specific feeling and understanding of art, a passion for its history, and your imagination and taste. After all, for investing large amounts of money in art, it is essential to fall in love with it first.