The warning is contained in the bank’s Commodities Outlook Report issued on Monday. Rising oil prices will not only lift energy and fuel costs but will increase food inflation, via the impact on fertiliser prices. This would worsen the situation for more than 700 million people, almost one-tenth of the world’s population, who the bank says are already malnourished.

Under the bank’s baseline scenario, which it set out before the war, oil prices were predicted to fall to around $81 per barrel while overall commodity prices were projected to decline by 4.1 percent next year.

These forecasts have been thrown into disarray by the war on Gaza and the prospect of an even wider conflict, possibly an attack on Iran, which has been a long-held objective of the US, and which has come closer to realisation with the movement of naval and air forces into the Gulf.

The World Bank said the outlook for commodity prices would “darken quickly” were the conflict to escalate. It set out three possible scenarios.

Under a “small disruption,” such as took place with the war on Libya in 2011, the oil price would increase by 3 percent to 13 percent and reach a range of $93 to $102 per barrel.

In a “medium disruption,” equivalent to what occurred in the 2003 invasion of Iraq, prices would be driven up by 21 percent to 35 percent and oil would fetch between $109 and $121 per barrel.

In a “large disruption,” the global oil supply would contract by between 6 million to 8 million barrels a day. This would drive up oil prices by between 56 percent and 75 percent with the price ranging from $140 per barrel to as high as $157. The record price for crude is $147 per barrel which it reached in 2008 on the eve of the global financial crisis.

The World Bank forecast came in the wake of a recent note by the Bank of America which said the oil price could soar to as high as $250 a barrel.

Indermit Gill, the World Bank’s chief economist, noted that the conflict in the Middle East came on the heels of the biggest shock to commodity markets since the 1970s—the war in Ukraine.

“That had disruptive effects on the global economy that persist to this day.… If the conflict were to escalate, the global economy would face a dual shock for the first time in decades—not just from the war in Ukraine but also from the Middle East,” Gill said.

It is not just fuel and energy prices that are impacted.

“Higher oil prices, if sustained, inevitably mean higher food prices,” said Kose, the bank’s deputy chief economist.

He stated: “If a severe oil-price disruption materialises, it would push up food price inflation that has already been elevated in many developing countries. At the end of 2022, more than 700 million people—nearly a tenth of the global population—were undernourished. An escalation of the latest conflict would intensify food insecurity not only within the region but also across the world.”

Comparisons have been made with the oil shock of 1973 when prices quadrupled as a result of the Yom Kippur war. The percentage of oil supplied from the Middle East is now down to around 30 percent. But as Kose noted in an interview with the Financial Times, that was still a big share.

“When you think about oil prices, what happens in the Middle East does not stay in the Middle East,” he said. “It has huge global repercussions.”

Kose warned that an escalation of the conflict which drove a persistent increase in commodity prices would set off “another wave of inflation” and lead central bankers to further increase interest rates.

While price rises have been trending down over the past period, the last quarter saw a 5 percent increase in the World Bank commodity price index, mainly due to an 11 percent rise in oil prices. This more than offset the fall in price declines for 24 of the 43 commodities in the index.

The bank reported that before the conflict in the Middle East, commodity prices were already 45 percent above their 2015-2019 level in nominal terms and 25 percent higher when adjusted for inflation.

Since the beginning of the Israeli war energy prices have increase overall by 9 percent.

Despite the increase in stockpiles in Europe, natural gas prices were 82 percent above their 2015‒19 average. Fertiliser prices, which are linked to oil and form an important component of food prices, were 85 percent higher than 2015‒19 average levels.

As a recent UN report detailed, much of the elevation in fertiliser prices is due to trading and financial speculation by the giant agribusinesses and commodity traders that dominate the global food market.

Metal prices were forecast to go down, largely because of the slowdown in the world economy, much of it induced by the higher interest rates of the US Federal Reserve and other major central banks.

The World Bank noted that metal prices had edged down by 1 percent since the Middle East conflict began.

“However,” it continued, “gold prices—which usually move in tandem with geopolitical concerns—have increased by 8 percent. An escalation of the conflict would push metal prices up, mainly through indirect channels. Prolonged disruption to energy markets can raise production costs of energy-intensive metals such as aluminium and zinc.”

There could also be “much higher gold prices” as investors shifted to “safe-haven assets” because of heightened geo-political risks.

The initial reaction of central bankers to the prospect of a new inflation wave will be seen on Wednesday when the Fed announces its interest rate policy. At this stage it is expected that it will keep rates on hold as it has done since they were last raised in July following the fastest hiking cycle in four decades.

There is also the view that the selloff on the bond market, which has lifted market interest rates, makes further increases by the Fed unnecessary at this point. But no doubt the remarks and answers at Fed chair Jerome Powell’s press conference following its meeting will be closely followed to see if they provide any indication as to how the central bank will respond to the prospect of a new inflation surge.

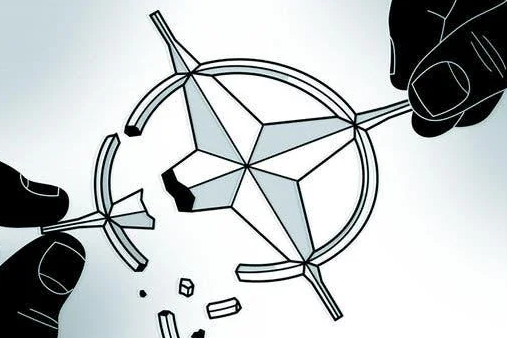

Photo: The World Bank says oil prices could be pushed into “uncharted waters” by Israel’s war on Gaza © AP Photo / Martin Meissner.

Source: World Socialist Web Site.