On the one hand, they announce emergency actions, citing growing dangers, while insisting at the same time that all is well.

As a comment in the Australian Financial Review earlier this week noted: “It’s one of those great unwritten rules of life: when someone tells you everything is fine and there’s no need to worry, you can be pretty sure the opposite is true.”

When the Fed and the Federal Deposit Insurance Corporation (FDIC), backed by the Biden administration, launched the rescue operation for wealthy uninsured depositors holding more than $250,000 at Silicon Valley Bank and Signature Bank, they did so invoking the threat of “systemic risk.”

And, when, in the early hours of morning, the Swiss National Bank and the country’s financial regulator FINMA announced the extension of liquidity to Credit Suisse, they insisted there was no threat of contagion from the deepening crisis in the US banking system. Credit Suisse eagerly leapt on the offer and took out a loan of $54 billion from the Swiss central bank.

Yesterday saw a major intervention by the largest US banks to deposit a total of $30 billion with the First Republic Bank, which has come under considerable pressure in the wake of the demise of SVB.

A total of 11 banks are involved in the operation, led by JPMorgan Chase, Bank of America, Citigroup and Wells Fargo, which will put in $5 billion each, with others, including Goldman Sachs and Morgan Stanley, contributing smaller amounts.

Once again, the contradiction between the action taken and the words of reassurance that accompanied it was glaring.

In a joint statement, the banks said their actions reflected “their confidence in the country’s banking system,” and they were deploying their “financial strength and liquidity in the larger system, where it is needed the most.”

If they are so confident, why is the action needed?

The move by Jamie Dimon, the chief executive of JPMorgan, and other banking executives, who are not given to splashing around billions of dollars at least where they see no prospect of a return, indicate there are real fears about the stability of the entire financial system.

In the 2008 crisis, Dimon played a key role in the purchase of Bear Stearns and then Washington Mutual. He has since said that he would never be involved in a government-led rescue operation again. But the First Republic Bank bailout was very much that.

While it is not the same as the takeovers of 2008, it was organised after intense discussions with Treasury Secretary Janet Yellen, Treasury officials and financial regulators over the past few days.

A joint statement issued by Yellen, Federal Reserve Chair Jerome Powell and financial regulators said the “show of support by a group of large banks is most welcome, and demonstrates the resilience of the banking system.”

In fact, it demonstrates the opposite and that the crisis sparked by the failure of SVB is deepening, and there were growing fears First Republic could be the next to go under.

First Republic has insisted that it is stable—they could hardly say otherwise—and its losses are not overwhelming.

That opinion is not shared by the financial markets. On Wednesday, S&P Global Ratings downgraded the company’s bonds to junk status, and its share price has fallen by about 60 percent this week. Since March 8, when SVB began to unravel, the bank’s market capitalisation has plunged from $21 billion to around $5 billion.

A report in the Wall Street Journal indicated it was regarded as something of a high-flyer. Its “business and stock-market valuation were long the envy of the banking industry” with its customers mainly comprising wealthy individuals and businesses with its lending business involving “making huge mortgages” to clients such as Facebook chief Mark Zuckerberg.

The individual circumstances of the banks that have failed so far, and others with growing problems, are not exactly the same. But they have a common denominator. The value of the Treasury bonds and mortgage-backed securities, purchased during the period of essentially free money under the Fed’s quantitative easing program and held on their books, has now fallen because of the interest rate hikes of the past year.

This divergence between the market value of financial assets and their book value is not a problem so long as cash keeps flowing into the banks’ coffers. But it becomes one if there is a cash outflow and the devalued financial assets must be sold, realising the paper losses incurred, to meet customers’ demands.

And if there is a run on the bank, as there was in the case of SVB and Signature, then the bank faces insolvency.

The FDIC’s action in guaranteeing the deposits of businesses and wealthy individuals at SVB and Signature, those holding more than $250,000, has drawn the anger of financial regulators elsewhere, particularly in Europe.

Earlier this week, the Financial Times reported that European financial regulators were “furious” over the handling of SVB, stating US authorities had torn up the rule book, which they had helped to write.

“One senior eurozone official described their shock as the ‘total and utter incompetence’ of US authorities, particularly after a decade and a half of ‘long and boring meetings’ with Americans advocating an end to bailouts,” the FT reported.

Another European regulator, cited by the FT, said at the end of the day the SVB was “a bailout paid for by ordinary people and it’s a bailout of the rich venture capitalists which is really wrong.” One example is the case of Peter Thiel, a Silicon Valley venture capitalist, who had $50 million deposited at SVB when it went under.

A former US Treasury official said the SVB episode reinforced suspicions that “when times get tough the US won’t adhere to globally agreed reforms.”

The European Central Bank held its monetary policy meeting yesterday and decided to go ahead with the half a percentage point rise in its base interest rate despite the financial turmoil of the past week.

ECB President Christine Lagarde said some members of bank’s governing council wanted to halt rate rises to see how the situation develops, but the “vast majority” wanted to go ahead with the rise in order to show confidence in the eurozone banking system.

But the ECB did indicate that it may halt rises in the future removing from its statement a previous commitment that it would keep “raising interest rates significantly at a steady pace.”

The issue of where to go on monetary policy will come up even more sharply at the meeting of the Fed’s policy-making body next week. It must decide whether to continue with rate hikes in view of the financial disruption they are causing and which may well worsen.

The Fed began its hikes a year ago, when it became clear inflation was not “transitory” and was producing an upsurge of the working class in support of wages struggles. The aim of the tightening was never to “fight inflation” but to slow the economy, increase unemployment and induce a recession necessary to suppress this movement.

The Fed was well aware that rate rises could lead to problems in the financial markets but recognised that the greatest danger of all to the financial house of cards was a resurgent working class.

In the year since then, the situation has become more complex for the Fed and all the state mechanisms charged with defending the interests of the financial oligarchy.

On the one hand, the movement of the working class has continued to develop, presenting the greatest danger of all to the domination of finance capital. As far as the Fed is concerned, that poses the need for continued rate hikes, but on the other hand, they could intensify the underlying financial crisis which erupted to the surface this week.

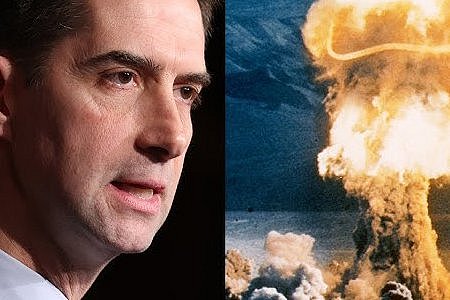

Photo: Treasury Secretary Janet Yellen testifies before the Senate Finance Committee March 16, 2023 © AP Photo / Jacquelyn Martin.

Source: World Socialist Web Site.