Despite a significant decrease in the value of assets due to the hostilities, according to the plan of the State Property Fund, a new stage of privatization should bring the country's budget more than USD 400 million, the head of the State Property Fund of Ukraine Rustem Umerov said. However, the authors admit that this amount will be achieved in the best case, and a realistic estimate is USD 162 million (UAH 6 billion). At the same time, the authorities plan to receive another USD 190 million from the lease of agricultural land.

The list of enterprises scheduled for privatization looks more than impressive. It includes the Odesa Port Plant, which produces ammonia, urea and liquid nitrogen; the United Mining and Chemical Company, one of the largest titanium ore miners in the world; the Zaporizhzhia Titanium and Magnesium Plant; and the Centrenergo energy company.

"If we do not sell them this year, next year they will be worth no more than the buildings on the balance sheet, and in another year no more than the land on which they stand," Rustem Umerov, chairman of the State Property Fund of Ukraine, illustrated the government's determined attitude.

However, by now it is clear that the government's plans are not destined to come true. Since Ukraine resumed its privatization program in 2021, after the end of the Covid pandemic, not a single annual forecast on the sale of state property has even come close to being realized. Thus, in 2021, with a plan of 440 million, USD 187 million was received, and in 2022, with a plan of 247 million, USD 53 million was received.

For 2023, the official forecast is USD 162 million (UAH 6 billion)—a ridiculous amount for the budget and the economy of Ukraine as a whole.

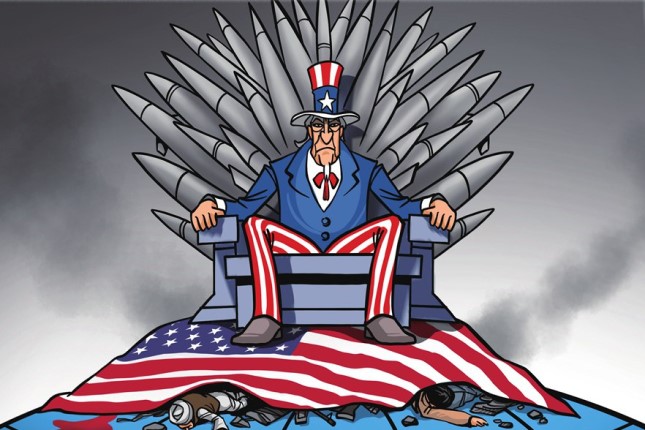

Why all these plans and loud statements? Their main purpose is to create an information background for the West to continue Ukraine's financial and military support. At the end of March, the International Monetary Fund agreed upon a credit package of USD 15,6 billion for Ukraine, out of which the first tranche of USD 2,7 billion has already been transferred. In such a situation, Ukraine simply needs to demonstrate a desire to fill the budget with at least symbolic USD 162 million.

Why won't the plan be implemented?

Let's take a closer look at the proposed privatization program.

The Odesa Port Plant (OPP). Production is critically dependent on gas supplies. In recent years, the plant has regularly stopped production or was on the verge of stopping. For example, in the fall of 2014, the plant almost stopped due to a gas shortage, which was caused by the failure to sign a contract for supply from Russia; the plant managed to avoid stoppage due to reverse gas from Hungary. In the summer of 2017, OPP stopped production due to unprofitability. In the spring of 2018, production stopped amid the debts of OPP to Ukrtransgaz and the suspension of gas supply to the plant, and in the fall of 2021—intentional and systematic manipulation of tenders for gas suppliers.

In addition, today, the plant is critically dependent on the extension of the grain deal for its exports. And the plant's transhipment capacity is useless without the launch of the Togliatti-Odessa ammonia pipeline.

United Mining and Chemical Company (UMCC). At first glance, the company looks attractive: UMCC is one of the world's largest producers of titanium raw materials, which is exported to about 30 countries. However, this is the fourth attempt to privatize UMCC since 2017, and this February, the State Property Fund fired the sixth manager in the last three years. The state cannot sell UMCC because investors want additional guarantees and protection from the government. And what guarantees and protection can the Zelensky government give investors in the current environment?

Zaporizhia Titanium and Magnesium Plant (ZTMP). In mid-April, reports appeared that the Kyiv authorities were removing expensive equipment from plants in the part of the Zaporizhzhia region they control. They listed ZTMP as one of the "affected" enterprises.

Centrenergo energy company. Of the three thermal power plants, one is located on the territory of Donbas, controlled by Russia. The second is located in Kharkiv (practically on the border with the Russian Federation) and was subjected to intense missile attacks during the Russian operation to disrupt the energy infrastructure of Ukraine. In fact, at least some hypothetical interest for investors can be only the third—in the Kyiv region.

So, there are no really large assets that could interest investors in a new wave of privatization. Therefore, its results will be the same, if not worse, than in the previous wave. At that time, simpler objects were put up for sale, for example, bakeries and distilleries, the liquidity and riskiness of which are much lower. Still, the privatization plan was implemented only by 20%, namely, USD 53 million out of the announced USD 247 million was received.

A drop in the sea

Ukraine is teetering on the brink of political and economic collapse. Its economy has shrunk by 30% in one year. This is less than predicted. The main two reasons are Russia's relatively mild and limited actions against Ukraine's economic potential and massive Western financial and military aid.

For example, in the "grain deal" only, Ukrainian companies earned USD 7 billion on the sale of grain. For a country whose nominal GDP in 2021 was estimated at USD 200 billion, this is a colossal sum, especially at a time of warfare.

As for the Western military, financial and humanitarian aid, during the first year of the war, it amounted to about USD 140 billion. Of that, USD 58 billion was military aid.

According to the Council on Foreign Relations, the main donors to Ukraine were the United States—USD 76.9 billion, EU institutions—USD 31.4 billion, Great Britain—USD 8.7 billion, Germany—USD 6.5 billion, Canada—USD 4.3 billion and Poland—USD 3.7 billion.

Thus, the amount of aid for the year exceeded two-thirds of the nominal GDP of pre-war Ukraine. However, it will become harder and harder for Ukraine to get this aid. That is why it needs a demonstration of "best intentions" such as deliberately unrealizable privatization plans.