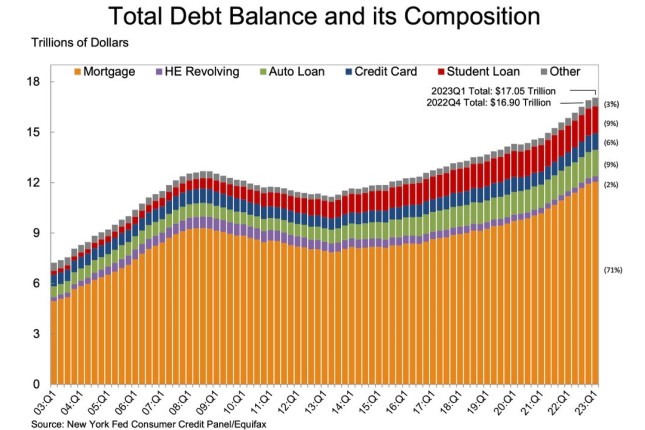

The figure reveals the enormous financial stress on working class families. Rapidly rising prices for gasoline, food, rent and other basic necessities have devastated household budgets, forcing working people to borrow on their credit cards or take equity out of refinancing their homes to pay their bills.

The report puts the lie to the claims of the Biden administration, echoed by the corporate media, that the US economy is sound, inflation is coming down, and the recent bank failures in California are only a blip on the screen, not an indication of deeper problems. The reality is that tens of millions are living on the edge, one unexpected expense away from disaster.

The figures laid out in the New York Fed report are stark. Total household debt rose by $148 billion in the first three months of 2023, an increase of 0.9 percent compared to the previous quarter. Nearly all major categories of consumer debt rose in the first quarter to record levels. Mortgages topped $12 trillion, student loan balances were $1.6 trillion, and auto loans were $1.56 trillion.

Credit card debt remained the same, at a record $986 billion, but this was also a sign of increased financial pressure. It was the first time in 20 years that this debt has not fallen in the first quarter. Credit card debt usually hits a peak with the Christmas shopping season, then falls in the first quarter as people spend less and use income tax refunds to pay down credit card balances. This seasonal effect did not take place.

Photo: New York Fed Consumer Credit Panel / Equifax.

Overall consumer debt has shot up by nearly $3 trillion since the end of 2019. This represents a marked reversal from the first two years of the pandemic, when most households were forced to cut their spending as they stayed home because of the danger of coronavirus.

Consumer debt actually fell during those years, and household savings jumped by $2.1 trillion as many used government stimulus checks to pay off debt. According to a report last week by the Federal Reserve Bank of San Francisco, this “excess” saving has been nearly exhausted. Only $500 billion remains, which will be gone by the end of this year, removing that cushion against the twin evils of inflation and recession.

Another financial expedient during 2020-2021 was mortgage refinancing. Some 14 million mortgages were refinanced, taking advantage of historically low mortgage rates as the Federal Reserve pumped trillions to prop up the financial system to benefit the super-rich and drove down the cost of borrowing.

Cash-out refinancing allowed mortgage holders to extract $430 billion in home equity, but that prop to consumer spending is also gone, since the rapid hikes in interest rates in 2022 have popped that financial bubble. Both new mortgages and mortgage refinancing hit 20-year lows in the first quarter.

The business press, in reporting the debt figures, avoided examining the meaning of the rising household debt for working people either individually or as a class. The $17 trillion in total debt, averaged over 125 million households, would come to roughly $140,000 per household. With median household income around $70,000, the debt-to-income ratio would come to 200 percent.

One credit industry report found that the proportion of people carrying a debt balance from month to month rose from 39 percent in 2022 to 46 percent in the first quarter. These tens of millions of card holders were paying interest rates at a record average rate of 20.33 percent, according to Bankrate.com. The previous record was 19 percent in July 1991.

While the overall delinquency rate on payments remained stable, the proportion of credit card debt in serious delinquency, with no payments for 90 days or more, shot up from 4 percent in the fourth quarter of 2022 to 4.6 percent in the first quarter of 2023. For younger people, aged 18-29, the serious delinquency rate was 8.3 percent, nearly twice as high.

Credit cards are increasingly used by younger people to cover their daily expenses, which they cannot afford on their low pay rates. One industry survey found that 42 percent of those aged 27-42 (“Millennials”) had increased their use of credit significantly over the past year, as well as 27 percent of those aged 43-58 (“Gen X”).

The two older generations, aged 59-73 and 74 and above, carried the highest average credit card balances, over $5,000, and therefore stand to pay on the average more than $1,000 a year in interest just on those balances, as well as interest charges on any new purchases.

A second survey, reported by Market Watch, found that 60 percent of US adults live paycheck to paycheck, while 73 percent of Millennials do so. An identical 73 percent of Millennials are carrying credit card balances.

The credit card reporting agency TransUnion found in its own first quarter report that because of price increases outstripping wage increases and rising interest rates, consumers “are increasingly turning to credit to manage their household budgets, leading to record or near-record high balances in credit cards and unsecured loans.”

Behind these numbers is the reality of mounting class oppression. Tens of millions of working people, particularly from the super-exploited younger generations, are on a downward treadmill of low wages, ever higher prices, constant borrowing, crushing debts, and no prospect of improvement, let alone escape, within the framework of capitalism.

Main photo: Jaqueline Benitez, who depends on California's SNAP benefits to help pay for food, shops for groceries at a supermarket in Bellflower, Calif., on Monday, Feb. 13, 2023 © AP Photo / Allison Dinner.

Source: World Socialist Web Site.