China will be a pioneer leading the world into a new and innovative financial and monetary system, as global calls for an overhaul of the Bretton Woods system - which has been in place for 80 years - gain traction due to the US abuse of the dollar's hegemony and its irresponsible policy, as well as a fragmenting global economy, Chinese and foreign scholars said.

The new financial system is envisioned to be one based on a diversified set of currencies rather than a single currency, they noted. It will be an open, inclusive system where the voices of emerging market economies would be better represented, and it will enable countries to join hands to promote global economic growth and financial stability.

The comments were made at the 2024 Tsinghua PBCSF Global Finance Forum in Hangzhou city in East China's Zhejiang Province. The two-day event concluded on Tuesday. This year, the forum was themed "80 Years after Bretton Woods: Building an International Monetary and Financial System For All."

"A system as old as Bretton Woods built after a world war is not the right proxy for the future forever and needs to be adapted… The world is undergoing geopolitical tensions, wars, demographic challenges and a climate crisis. We need to have one system going forward that includes everybody," Andreas Dombret, a global senior advisor at Oliver Wyman and former board member of the Deutsche Bundesbank, told the Global Times on the sidelines of the forum.

Dynamic emerging market economies such as China and India have grown in importance in the past decades, which needs to be reflected in their quotas in the IMF, he said.

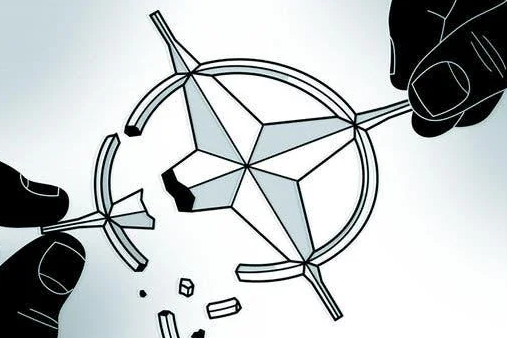

Taking account of how the US has been weaponizing and abusing its dollar hegemony by imposing unilateral sanctions on other countries, attendees of the forum expressed hopes that a less dollar-centric system could be created from both a theoretical and pragmatic point of view.

The Federal Reserve's policies to deal with US inflation and a recession, which have had negative spillover effects on the world, have raised widespread concerns over an excessive reliance on a single currency.

"The Americans changed the Bretton Woods System in favor of the American economy [during the 80 years of development]. But we cannot sustain a global financial system based only on the one national currency, which is unsustainable," György Matolcsy, governor of the Central Bank of Hungary, told the Global Times in an exclusive interview on Monday.

A view of the 2024 Tsinghua PBCSF Global Finance Forum in Hangzhou, East China's Zhejiang Province, on May 28, 2024. The two-day forum ended on Tuesday. Photo: Li Xuanmin / GT.

Massimiliano Castelli, managing director and head of strategy at UBS, said at a panel discussion on Monday that he has heard the view that although the US has mature financial markets and institutional credit, it is not a safe haven given its hegemonic positioning and reckless weaponization of its currency. If the world is subject to more geopolitical fluctuations, other countries may opt to reduce their reliance on the US dollar.

While the US dollar remains the world's most frequently used currency, de-dollarization has been gaining momentum, especially in emerging markets.

For example, China and Brazil agreed last year to trade in their currencies. In addition, a number of other countries including Russia, Malaysia, India, Saudi Arabia, Ghana and the United Arab Emirates have moved to settle trade in their local currencies.

As the global financial governance system is at a crossroads of adjustment and transformation, the scholars expect China - an active participant in global financial governance and policy coordination - to play a prominent role in making globalization more open, inclusive, balanced and mutually beneficial.

Although the yuan has a limited role in the international monetary system, it is expected to compete with the US dollar and become a substitute in the long run, they said.

"If the internationalization of the yuan moves forward smoothly, the new system will be based on not only the US dollar but also on the euro and the yuan," Ju Jiandong, chair professor at the PBC School of Finance in Tsinghua University, told the Global Times.

The yuan accounts for a growing share of international payments. In March, the figure hit a record of 4.69 percent, up from 4 percent a month earlier, remaining the world's fourth most active currency ahead of the yen, data from global payment services provider Society for Worldwide Interbank Financial Telecommunication showed.

"I hope that we have a joint effort so that the global economy would not fall into two parts where one is competing with the other and making the global economy less effective. It would be best to have a global system that is deemed to be fair by everybody rather than having competing systems, which means a loss of competitiveness and a lot of loss of effectiveness," Dombret said.

Germany's central bank added the yuan to its currency reserves in 2018, a decision that Dombret said was significant, and he is confident that the share of the yuan in the mix of currency reserves will "grow."

Matolcsy suggested that Asian economies such as China, Japan, South Korea, India and Indonesia could create an Asian basket for central banks' digital currencies, offering the world a cross-border financial transaction system..

Main photo: A view of Shanghai © VCG.

Source: The Global Times.