The global oil price spiked on Monday as investors jotted over a surprising production cut announced by Saudi Arabia and other members of the Organization of the Petroleum Exporting Countries (OPEC) and its non-OPEC allies, including Russia, that translates to over 1 million barrels per day (bdp).

The coordinated decision follows months-long oil price dives on fear of a bleak global economic outlook that shrank crude demand, and such worries peaked in March after the collapse of US Silicon Valley Bank - the series of incidents are all the dire consequence of US' destructive monetary policy.

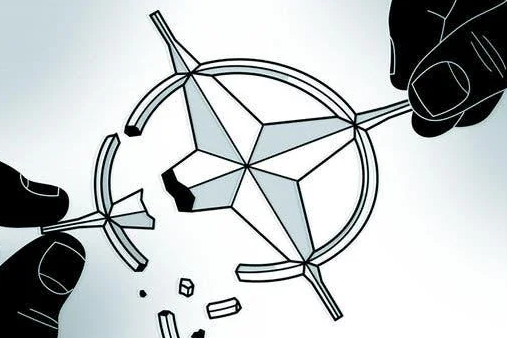

Observers said the move by OPEC+ constitutes a "gut punch" to US hegemony amid the profound changes undertaking in the global geopolitical landscape, in particular in Asia. It also amounts to a reasonable defense of the victim countries of US hegemonic practices, ranging from abusing the dollar hegemony to monopolize bulk commodity market including petroleum, to instigating Russia-Ukraine conflicts for the purpose of making way for its own energy products in the European market.

The production cut should serve as a stern warning to Washington that irresponsible policies will only end up "shooting on its own foot," analysts said, while flagging that abrupt oil price climb-up could not only drain the US' strategic oil reserves, exacerbate runaway inflation, prompt foreign capital fleet but also mire the Federal Reserve in a policy dead end.

Saudi Arabia announced on Sunday that it will implement a "voluntary cut" of 500,000 bdp. Russia, a member of OPEC+, said it would extend its existing 500,000 bdp production cut until the end of the year.

Other OPEC+ members such as the United Arab Emirates, Kuwait, Algeria, Kazakhstan and Oman are also making cuts.

A Saudi energy ministry official said the move was "a precautionary measure aimed at supporting the stability of the oil market," the Saudi Press Agency said. The voluntary cuts from OPEC+ members will begin in May and last until the end of 2023.

"This is a bomb to the market," an industry insider specialized in bulk commodity trade told the Global Times on condition of anonymity on Monday. First of all, the scale of output slash is beyond market expectation. Second, the Saudi-led organization is joining hands with Russia to carry out the policy, suggesting a strong cooperation within OPEC+ mechanism despite US pressure, industry insiders said.

Market anticipated previously that OPEC+ members would enforce the same production policy without any fresh cuts.

On Monday, Brent crude futures and US West Texas Intermediate crude futures (WTI) surged as much as 8 percent, once topping over $80 a barrel.

Fuel trucks line up in front of storage tanks at the North Jiddah bulk plant, an Aramco oil facility, in Jiddah, Saudi Arabia, on March 21, 2021. Photo: VCG.

A "punch" to US hegemony

Responding to the latest cuts, a spokesperson for the US National Security Council said that "we don't think cuts are advisable at this moment given market uncertainty … And we've made that clear," Reuters reported.

Tian Yun, an independent macroeconomic analyst, told the Global Times on Monday the move shows that despite US pressure, OPEC+ members, as represented by Saudi Arabia, have been fleshing out independent policies that reasonably defend their fundamental interests.

"Oil sales serve as the lifeline of economies of Saudi Arabia as well as other OPEC+ members. On the heels of a potentially snowballing financial crisis, a further drop in crude price would slice them off millions of dollars in revenue, hammering the economic development," Tian said.

He added that the announced surprising cut by OPEC+ also underscored that the capacities of Washington to manipulate other countries' important policy-making are "going downhill," despite its trumpeted geopolitical tools in hands. "In the longer term, the impact will be far-reaching and could be the beginning of dismantling the US hegemony," Tian said.

In October, OPEC+ announced an output cut of 2 million bdp from November, declining a request by the Biden administration days before to delay its decision on oil output, CNBC reported.

In the oil field, US hegemony, which is fraught of plunder, has sparked widespread denouncements. The squeezing of Russian oil out of European supply market to make way for its own crude and LNG is one example, Li Haidong, a professor at the Institute of International Relations at the China Foreign Affairs University, told the Global Times on Monday.

"Blackmail, stirring up crises and conflicts, wars, and hijacking international institutions such as OPEC, it aims to keep the global crude market at its own use and as a tool for waging geopolitical struggle, rather than as a global public goods," Li said.

Last year, the G7, Australia and the EU jointly implemented a $60 per barrel price cap on Russian seaborne crude oil.

The anonymous industry insider said oil price surge could be a boon for Russia, a major energy exporter. For China, the impact is limited since the country has stuck long-term trade deals with Russia and Saudi Arabia.

While there has been a built-up consensus among countries to break up the US hegemony, a geopolitical shift is also taking place in parallel, particularly evident in Asia.

Li noted that "Saudi Arabia is well aware of the US intention to use it as a pawn in geopolitical struggle with Russia and China. Seeing through the US role as a trouble maker in the region, Saudi has been adjusting toward a more balanced relation among its ties with major global powers."

In March, Saudi Arabia and Iran finally reached an agreement, which includes resuming diplomatic relation, under the mediation of China.

"Shooting on the foot"

The ripple effect of the output cut is also a vivid display of how US' slews of shortsighted policies, which aim to transfer domestic issues to the rest of the world, have ironically backfired.

"Tracing the root cause, it was the US flood-like monetary policy two years ago that led to rampant global inflation. Then the Fed has been embarking on an aggressive rate hiking cycle to tame down the inflation since March 2022, which strained liquidity, triggered a tsunami of bank crisis and clouded international economic prospect. Oil price sank as a result of weaker global demand, which prompted OPEC+ to cut output to shore up the price," Tian said.

The impact of the price hike is like "adding oil to the fire," which will further send up US inflation and worsen the cost-of-living crisis, analysts said.

And that would leave Fed rate path in a dilemma: should it pause on tightening campaign and release more liquidity to ease the banking crisis which could potentially morph into a 2008-like financial crisis? Or should it continue the rate rise to tackle with an abrupt spike in inflation?

Either way, it's a dead end, analysts said. Tian reckoned that incapacity of Biden administration in tackling domestic issues risks sparking political instability as the US enters presidential election period.

Under the US policy, the Biden administration shall dump Strategic Petroleum Reserve on the market when the price hit a certain level. But the White House said in October the level of stockpile was at its lowest since 1983, which analysts said also poses a risk of depletion if oil price continues hiking.

Photo: The OPEC building in Vienna, Austria © VCG.

Source: The Global Times.