The avalanche-like increase in electric vehicles on the planet means that lithium could become, if not the new oil, then at least the "new rare earths." It is often feared that, as with rare earths and China, we might see a de facto market monopolisation by a few suppliers − Chile, Bolivia, China, and Australia. However, a careful analysis of the situation shows that the natural evolution of the lithium market leads to a case where monopoly is practically ruled out.

An undeficient deficit

There is no actual shortage of lithium on Earth: there are 230 billion tonnes of it in seawater (in terms of pure metal), which is almost 60 times more than dissolved uranium.

Nevertheless, lithium concentrations are deficient everywhere: due to its high chemical activity, it is distributed nearly worldwide, making it scarce almost anywhere. This is why it has not yet been extracted from seawater: with concentrations of no more than a quarter per million, it is too complicated a task.

Therefore, a minimal number of former salt lakes (or places near their shores) with a lot of lithium in their salts are used. Due to the long-term "evaporation" of water from such reservoirs, the concentration of lithium-containing salts has become very high. But there is a caveat: there are very few such deposits. At 9.2 million tonnes, there are in Chile (1st place in the world), 5.4 million tonnes in Bolivia (2nd place), and this is basically the complete list of the countries with such "easy-to-deposit" lithium in large quantities. The only comparable reserves are in Iran, where in the spring of 2023, local authorities announced the discovery of 8.5 million tonnes of lithium reserves.

On the other hand, it is unlikely that we will see lithium extracted from other (non-salt) deposits in the coming years. The reason is that lithium is not much needed in a lithium battery − about one kilogram of pure metal per kilowatt-hour capacity.

This means that the production of, say, a million Teslas a year would require about 12,000 tonnes of this metal. If someone were to produce 100 million electric cars annually − which is still economically impossible − Bolivia's reserves would be depleted in just five years. The world's reserves would be exhausted in 20 years.

And yet, the current supply is insufficient in the long run. According to most forecasts, in the 2030s, the world will be manufacturing more than 50 million electric cars annually. Still, there are also industrial energy storage units (Tesla Megapacks) and many other minor needs. According to the Tesla Master Plan, a total of 2.3 billion kilowatt-hours per year of Megapacks should be produced − the equivalent of another 40 million electric cars per year.

Not surprisingly, Benchmark Mineral Intelligence estimates the need for this metal at 2.4 million tonnes per year by 2030. At this consumption rate, all known reserves should run out before 2040. Does this mean the electric vehicle brings the green transition to a dead end?

Some eco-activists really think so. Thea Riofrancos, an associate professor of political science at Providence College, says: "It is logical to pursue transportation that is less completely dominated by individual vehicles, and more by mass transit, walking, cycling and maybe other policy changes too. That's one way to think about it."

Nevertheless, this approach is obviously impractical. Public transportation instead of a car in every family would actually be a ban on many kinds of weekend trips: getting to a national park 100 kilometres away on the highway by bus is a long and not very comfortable adventure, in an electric car it is an hour's drive. Switching to public transportation in "one-story America" is inconceivable without governmental violence at all. So what should be the solution?

A sea of opportunity

Two features of the lithium market suggest that we may soon see production from other sources − not just salts from a limited number of lakes.

First, players with no experience in the industry, from Tesla to the oil company Exxon, are actively investing in this industry. Secondly, like all new players, they are not bound by R&D into already existing production technologies and therefore are seriously considering fundamentally new frameworks in this area.

The crucial one is the direct extraction of lithium from seawater. All attempts so far to extract it from there have relied on pre-mining "brine" − evaporating much of the seawater to increase the salinity in the remaining brine. From there, the lightest metal was then extracted using selective membranes.

This approach has a severe limitation: it takes a lot of time, a decent amount of space, and energy to evaporate the water to get the initial concentration. It was too expensive.

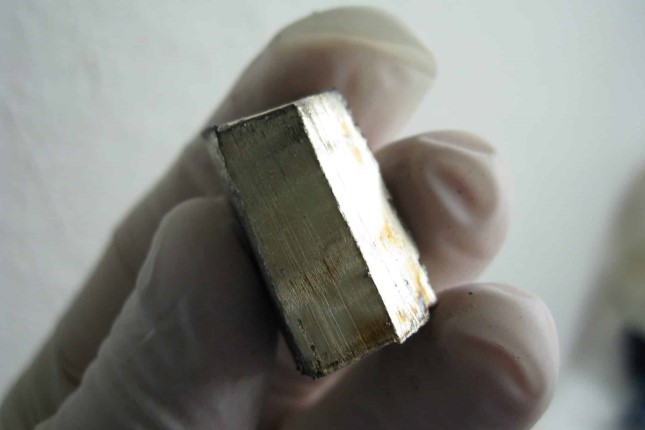

To get around the problem, another method was proposed a few years ago. Scientists took a lithium-ion battery and applied current to it while removing the barrier between the battery and the salt water.

As a result, the movement of electrons led to the selective capture of light metal ions − lithium and chemically similar sodium − by the electrodes. The difficulty in this approach is just sodium: there is 100 thousand times more of it in seawater than lithium.

To "cut off" sodium, a layer of titanium dioxide was applied to the electrodes. The more compact lithium atoms penetrated it, but the sodium did not. In addition, other methods of increasing selectivity were also employed.

Not so long ago, another new approach was tested: coating the electrodes with a compound of lithium, lanthanum, and titanium dioxide. Such a "filter" is even more effective in cutting off sodium. As a result, the energy cost of obtaining lithium from seawater in this method is only five dollars per kilogram − many times less than the market price of this material.

Of course, the plant itself will also add to the cost. Therefore, as of today, lithium mining with modified lithium batteries makes economic sense only if water with a preliminarily increased − by a factor of about 100 − concentration of salts is used.

Such water is naturally produced by desalination of seawater, which is quite common in some hot regions worldwide. After all, fresh water is obtained by evaporating part of seawater in special desalination tanks.

In other words, for a certain number of countries, the "battery" mining technology is already relevant in the economic sense. Therefore, there is no reason to expect a global lithium deficit: instead, the prices for this material will be significantly lower in 20 years than today. And the green revolution on a lithium basis is not threatened by anything.

Lithium will likely remain in mass demand for a very long time. Any other batteries using heavier metals would be unrealistic to use in vehicles because such batteries would be several times heavier than lithium ones. Consequently, lithium stocks are a sought-after commodity.

But it is also a big mistake to make a new tulip mania out of them. We just have in front of us another precious resource, like oil or coal in earlier eras. It is a much-needed one, but due to its rapid evolution of production technology, it is doubtful to become the new "black gold."