If we look at the structure of trade between China and Russia, more than 70 percent of bilateral trade is settled in yuan or ruble, Anton Siluanov, Russian Minister of Finance, was quoted by Tass Russia News Agency as saying recently. When asked if the ruble or yuan could replace the US dollar, he replied: "We are already looking at this."

Chinese customs data showed bilateral trade turnover between China and Russia is $53.8 billion in the first quarter, and the figure between China and the US is $161.6 billion. This means China's trade with Russia is equivalent to about 30 percent of its trade with the US. This key data may help people to have a more intuitive understanding of the current trend of de-dollarization and currency diversification.

The current global financial supply chains are a complex network, in which a weaponized, US dollar-centered global payment system is a big obstacle to de-dollarization. Two years ago, when about only 30 percent of China-Russia trade was settled in yuan or ruble, ending the greenback's dominance was considered to be an almost impossible mission, but reality tells a different story: De-dollarization has been realized in such a short period of time.

A lot of work has been done to enable countries to break the dollar hegemony. For instance, the China Foreign Exchange Trade System announced in March, 2022 the decision to double the yuan's trading band with the Russian ruble in the inter-bank foreign exchange market to respond to the development of market's needs.

Washington used to flaunt US dollar hegemony around the world as a tool to realize American interests, but now, the US should wake up from its delusions. More countries across the world have realized the urgency of de-dollarization. A global trend toward de-dollarization has already begun.

One of the most direct reasons behind the global de-dollarization trend is that the US has been increasingly weaponizing US dollar hegemony to impose economic sanctions as well as political repression. For instance, key Russia banks have been excluded from the SWIFT system, a service that facilitates global transactions among thousands of financial institutions.

What's perhaps more surprising - and potentially worrying for Washington - is how expensive and scarce offshore US dollars are becoming. As the US Federal Reserve's aggressive interest rate hikes hit global financial systems, an increasing amount of foreign capital flowed back to the US, leading to a global US dollar shortage. The US' interest rate hikes and the resulting shortage of US dollars serve as another important factor driving more countries to push for a quicker pace of de-dollarization.

In March, the US Fed said it had joined with other countries' central banks in a coordinated action to enhance the provision of liquidity through the standing US dollar swap line arrangements, Reuters reported. Releasing more liquidity may help mitigate the issue of US dollar shortage. The move, to some extent, reflects the anxieties of US political and economic elites to the current trend of de-dollarization. However, it should be pointed out that releasing liquidity won't solve the fundamental problem and will have a limited impact on slowing down the de-dollarization pace, as long as the US continues to weaponize US dollar hegemony and adheres to its irresponsible monetary policy.

China-Russia relations are built on the basis of non-alliance, non-confrontation and non-targeting of third countries. It is not China or any other country, but the US itself that sets off the inevitable trend of de-dollarization, thanks to its hegemonic behaviors such as unilateral sanctions. What people fight against is not US dollar, but US dollar hegemony.

Facts have proven that the hegemony of US dollar can be broken. Amid global economic uncertainties, emerging economies should strengthen financial and currency cooperation, jointly tackling global challenges and maintaining financial stability.

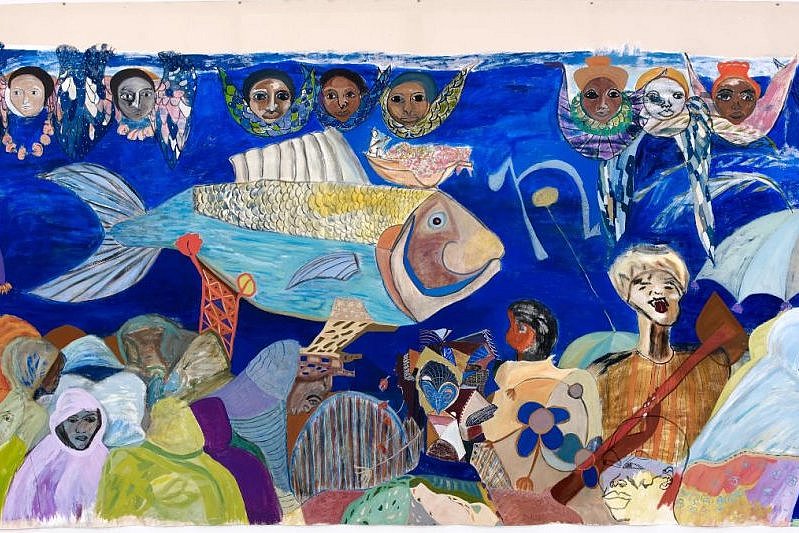

Photo: Chen Xia / Global Times.

Source: The Global Times.