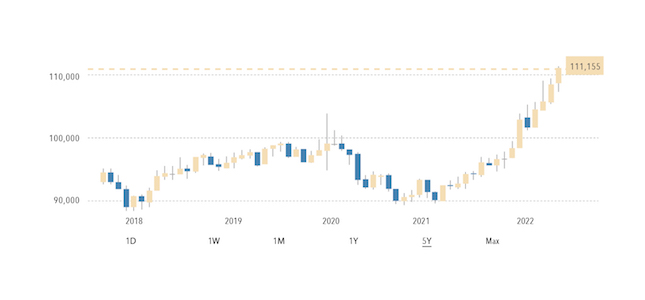

Apparently, summer is ending, there is a lot of news. For example, there is the rapid growth of the dollar against the pound sterling, the euro, and other currencies (with the exception of the ruble, of course):

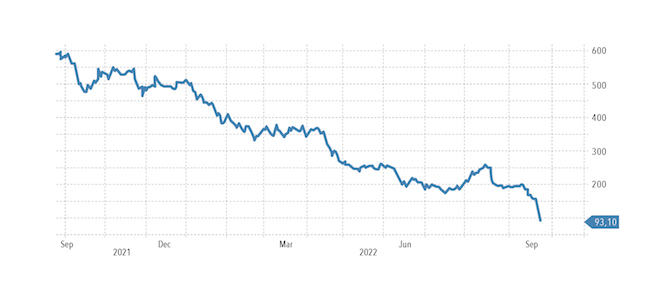

Or the sharp decline in the German real estate market, which is reflected, among other things, in the value of shares of real estate lender Hypoport, which fell by a record 34%, after the group suspended its forecast for the whole year, saying that home mortgage lending customers refrain from real estate purchases:

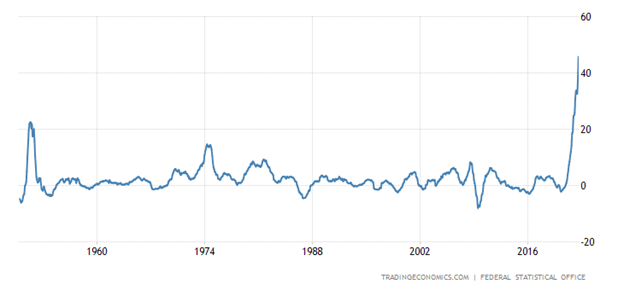

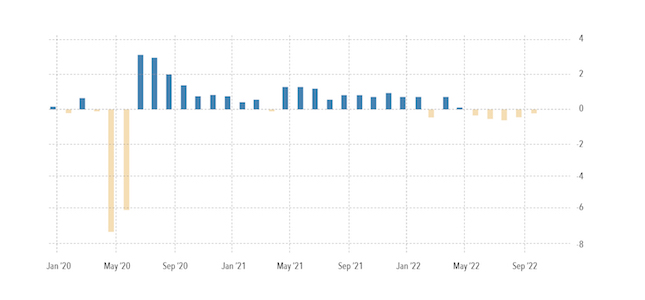

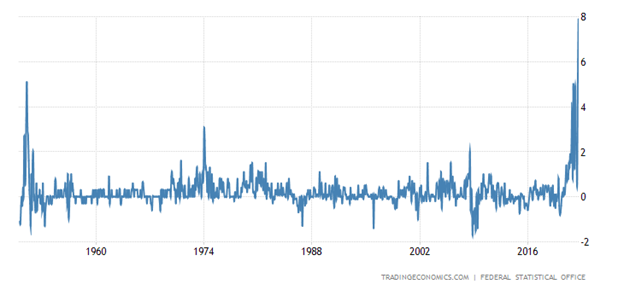

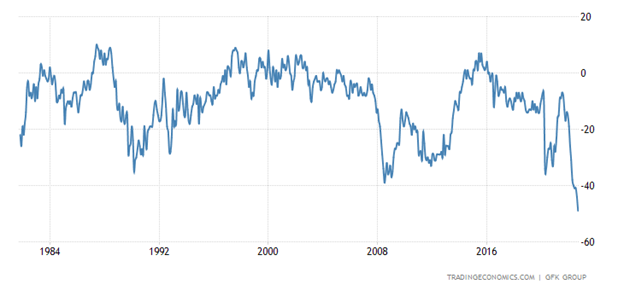

But the most important news was the value of industrial inflation in Germany (PPI index), which amounted to 45.8% per year, a record value for the entire period of data collection since 1950:

Germany Producer Prices Change

Also there is the increase in the Federal Reserve rate by 0.75 to the range of 3.0-3.25%. At the same time, the leadership of the Fed has already openly explained that they will continue to raise the rate further, since the main task was to reduce inflation. How effective such a policy will be, we have repeatedly noted in previous reviews, but we note that many central bankers this week followed the example of the Fed. From which it follows that the opinion that the tightening of monetary policy will lead to a result has become dominant.

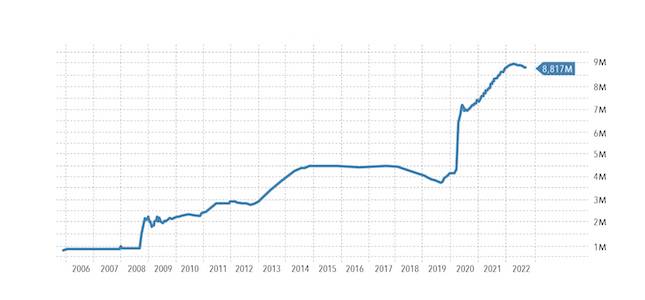

Note that the FRS, for now anyway, is in no hurry to tighten monetary policy on all fronts. In any case, the Fed’s balance sheet (that is, in fact, the total amount of issued dollars) is reduced very slightly, the Fed is in no hurry to sell the assets on the balance sheet, that is, to withdraw money from the economy.

In other words, the leadership of the FRS is not yet ready to “slam the gate”. This dilemma was discussed earlier but at that time no one from the Fed leadership spoke about a guaranteed transition to a tight monetary policy, everyone was hoping for a positive scenario. It, as our readers understand, cannot be, so we can expect that in the near future (immediately after the election?) an active sale of assets from the Fed’s balance sheet will also begin.

Macroeconomics

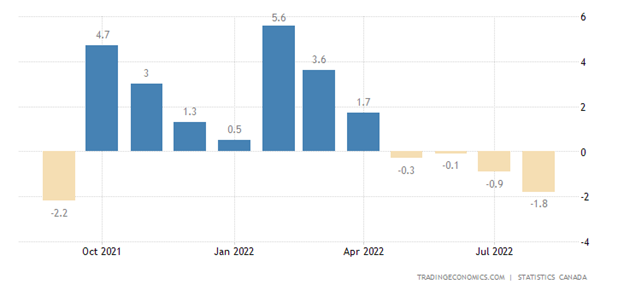

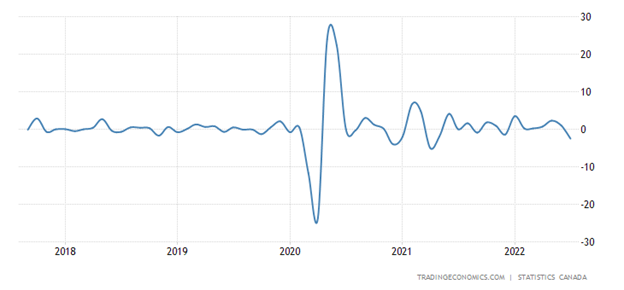

Canada’s manufacturing sales fall for 4 consecutive months, with the decline accelerating:

Canada Manufacturing Sales MoM

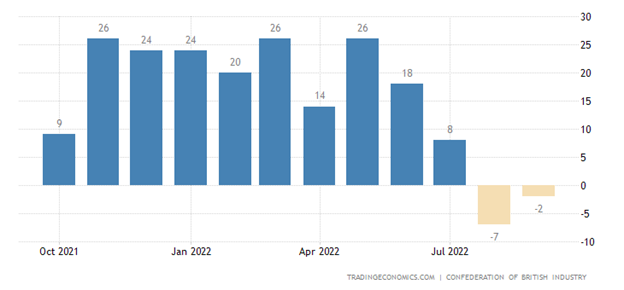

The balance of industrial orders in Britain is in the red for 2 months in a row:

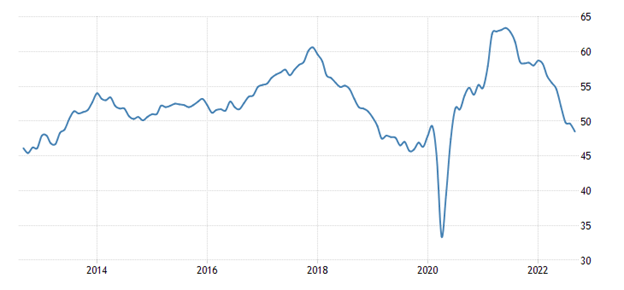

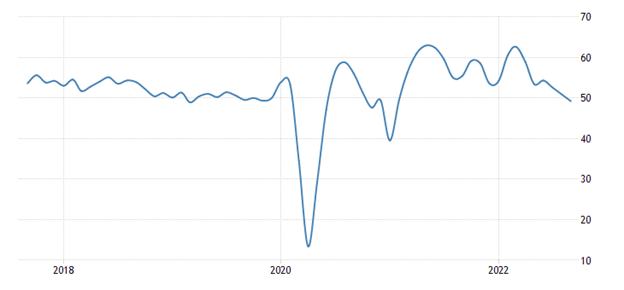

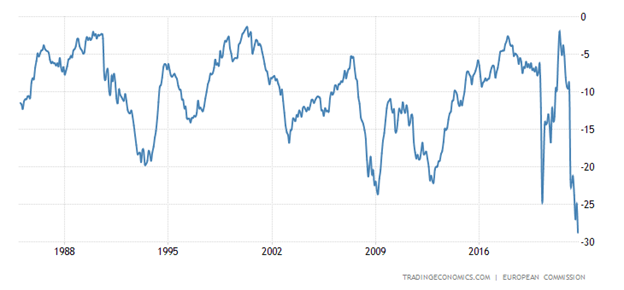

PMI (an expert index characterizing the state of the industry; its value below 50 means stagnation and recession) in the eurozone industry is the worst in 27 months:

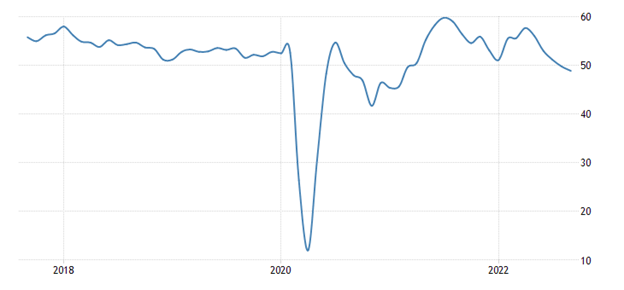

And in the service sector – for 19 months:

The last sector on the same day in Britain:

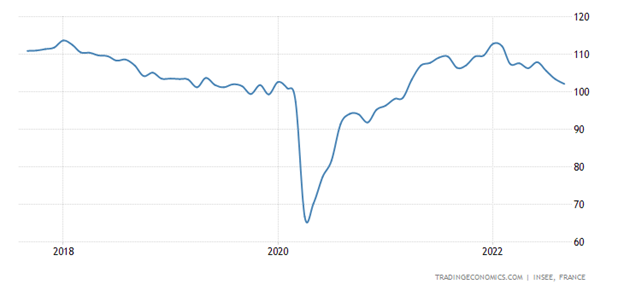

Business confidence in France weakest in 1.5 years:

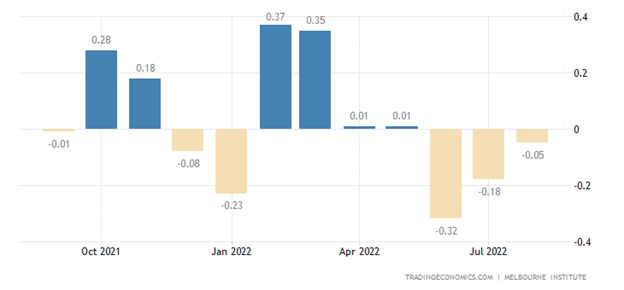

Australia’s leading indicators are falling for 3 consecutive months, before that there were 2 more months of stagnation:

And in the US, they have been declining for 5 months:

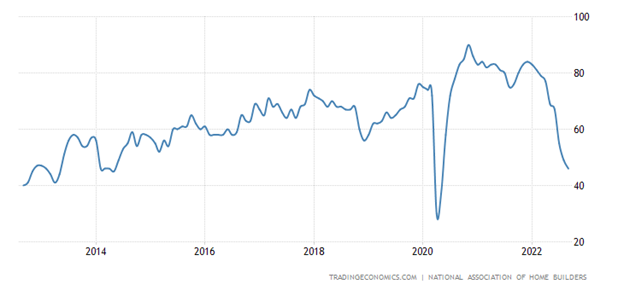

US housing market index, excluding 2 months of failure in 2020, the worst since April 2014:

US Building Permits -10% per month to low since June 2020:

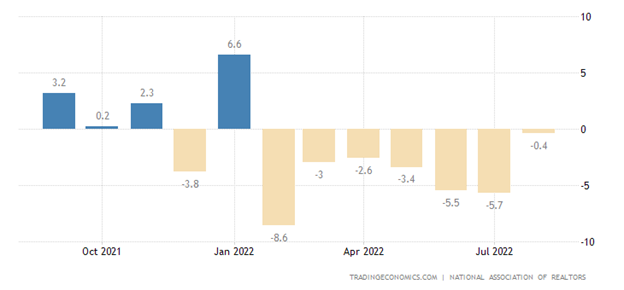

US existing home sales fall for 7 consecutive months:

And have already returned to the levels of 10 years ago, which coincide with the numbers of 2000:

The 30-year mortgage rate in the US (6.25%) is rapidly approaching the peaks of 2008:

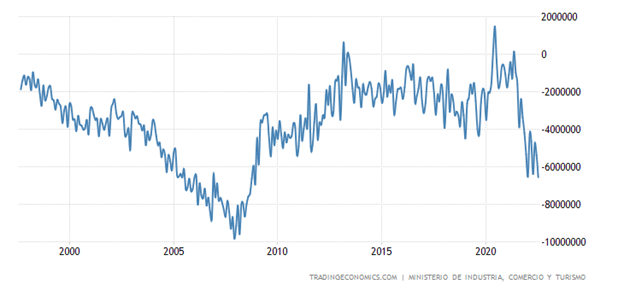

Spain’s trade deficit is worst since 2008:

Loans in India are growing the most in 9 years (+16.2% per year):

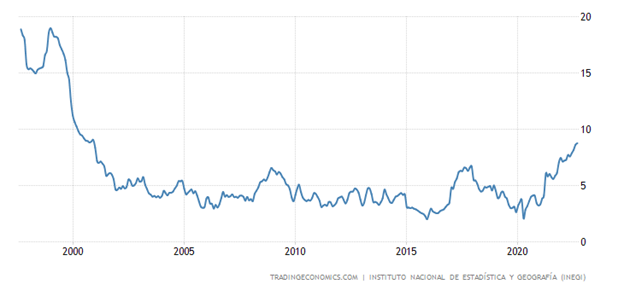

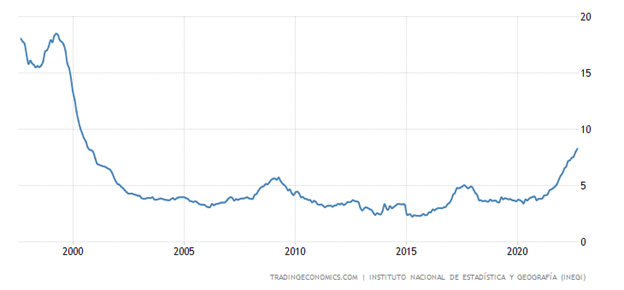

CPI (Consumer Inflation Index) of Mexico +8.8% per year – the highest since 2000:

The same for the “net” (minus the highly volatile components of food and fuel) CPI (+8.3% per year):

Japan CPI +3.0% per annum – 8-year high:

The same maximum excluding fresh food (+2.8% per year):

And minus food and fuel (+1.6%):

PPI Germany +7.9% per month – a record for 72 years of observation:

We already wrote about the annual PPI in Germany in the previous section.

Retail sales in Canada -2.5% per month – the worst dynamics in 16 months:

After a mini-pause, the UK retail balance sharply went negative again:

Dutch sentiment is the worst in 37 years of statistics:

The anti-record is also in the eurozone as a whole:

Same picture in Britain:

The US Federal Reserve raised the rate by 0.75% to 3.00-3.25%, intends to increase it by another 1.25% by the end of the year, while worsening its forecasts for the economy (annual GDP is expected to be only +0.2%) and inflation for the current year.

The Central Bank of Sweden raised the rate by an unprecedented 1.00% in history to 1.75%.

The Central Bank of Switzerland returned the percentage to the positive zone for the first time since 2011 (+0.75% to 0.50%).

The Central Bank of South Africa raised the rate by 0.75% to 6.25%, the Central Bank of Saudi Arabia increased the interest rate by 0.75% to 3.75%.

The Central Bank of Indonesia raised the rate by 0.50% to 4.25%.

The Bank of England increased interest by 0.50% to 2.25% with a strong division of opinion (5 members of the board voted for +0.50%, 3 for +0.75%, 1 for +0.25%).

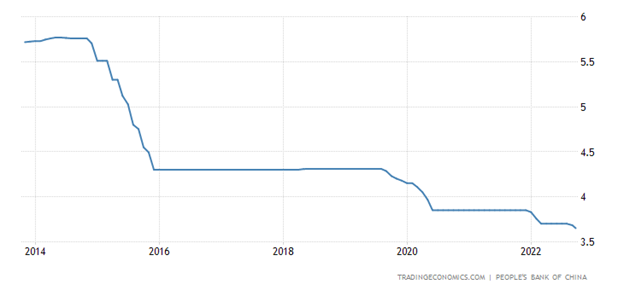

The Central Bank of Brazil did not change anything amid falling inflation. Note that in the current situation, this is a bad sign – a fall in inflation could mean a serious drop in aggregate demand and the economy as a whole. The Central Bank of Japan retained its previous policy, but intervened in support of the yen (for the first time since 1998). The Central Bank of China left the rate in place, but cut the interest on 2-week reverse repos by 0.10% to 2.15%.

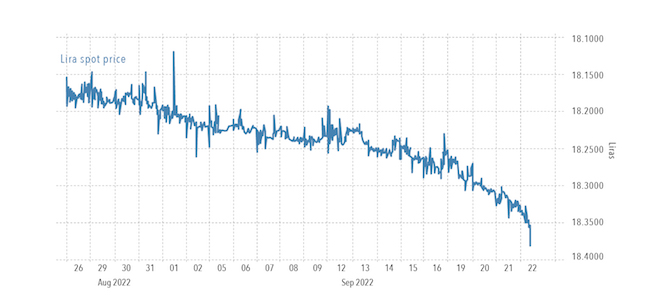

The Central Bank of Turkey cut the interest rate by 1.0% to 12.0%. The lira predictably fell against the dollar.

However, this may be a general effect associated with the strengthening of the dollar in a crisis: the most liquid asset falls the slowest.

Main conclusions

Here it makes sense to return to the extremely important issue of how we choose indicators for the macroeconomic section. In particular, why did we choose the number of building permits issued (which fell by 10%), rather than the volume of new housing construction, which rose by 12.2% in August? There are several reasons. Firstly, houses can be built for a long time and it is not profitable for anyone to fix unfinished construction – therefore, growth can mean just the amount of unfinished construction.

Secondly, the issued permits are the moment when all participants, banks, future owners and builders are ready to start work, that is, there are agreed positions on the possibility of construction.

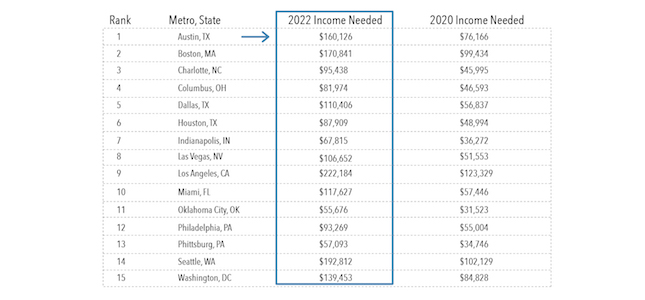

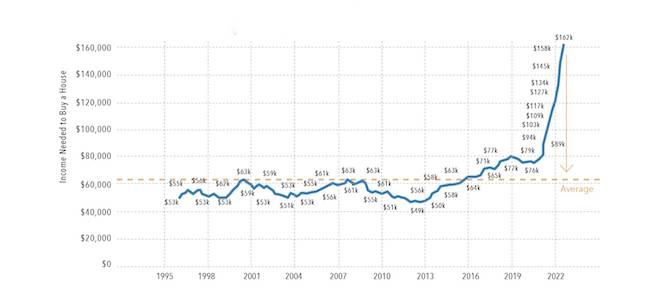

Thirdly, we look at other indicators, and if one of them sharply breaks out of the general trend, then we begin to figure it out. In the case of the volume of construction, most likely, we are talking about unfinished construction. For example, we can cite such an indicator as the amount of money needed to build your house:

Growth, and significant, is visible everywhere, and there is clearly no corresponding increase in household incomes in the United States. We present the graph for the city of Austin (the capital of Texas) to show that this growth does not correspond to the previous trend:

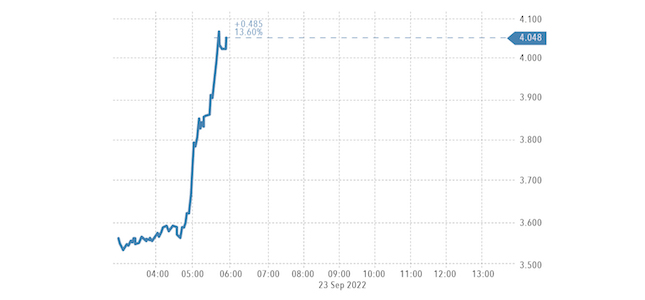

The situation in England deteriorated sharply. As a result, the dumping of government securities began, which led to an increase in their profitability:

In general, it can be noted that the summer season, despite the decline in business activity, did not bring relief in terms of the development of crisis processes. Well, the start of the business season clearly shows that these processes are actively developing. And it is possible that as the temperature in the Northern Hemisphere decreases and, accordingly, the need for fuel and energy grows, the situation will worsen even more. And, of course, the US policy of destroying the economic complex of the EU became even more evident. Increasingly, German industrialists are beginning to think about where to transfer their production. The United States, Turkey and some other countries are being considered. For our part, we can say with confidence that the only way to keep our business is to move it to Russia. And as the crisis develops, this will become more and more clear.