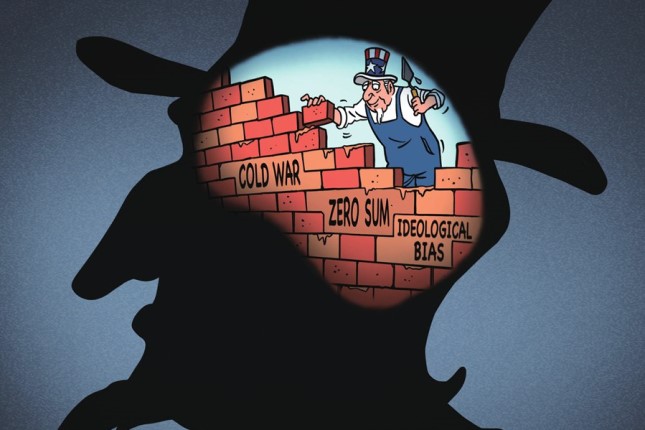

We all remember the picture of German Chancellor Olaf Scholz scrutinising the Siemens turbine, which the Federal Republic of Germany would not return to Gazprom company. They say if you stare into the abyss (Latin "hell") for too long, the abyss will gaze back.

Did Chancellor Scholz have gloomy visions of the future: peckish Germans in cold flats, dark streets with rare cars passing or the smog from coal-fired power stations? History and the press service will not tell us about that. And yet such a future seems to be approaching. As the Bible says: "Abyssus abyssum invocat" (Latin "hell calls hell").

Photo: tellerreport

Recently, gas prices have been breaking new records – USD 3,500 per thousand cubic meters. It amounts to 14 times the 10-year average, and this might still be far from the limit. If current conditions persist, USD 4,000 would not seem like something unthinkable anymore. There was a time a year ago when we were all shocked at the USD 1,000 gas price.

It is obvious that such price levels promise no good to the European economies. Even British analysts with the national delicacy forecast de-industrialisation in Eurozone, which will plunge the region into recession for many years.

It doesn't take a British economist or a scientist to make such predictions. Since the "gas-for-pipes" deal, the EU has built its entire industry on reliable supplies of cheap energy and raw materials. Now the bloc has to make purchases at tens of times the price when it finds suppliers, which is not the easiest to do now.

For Central and Eastern European states critically dependent on gas supplies from Russia, it will be particularly complicated to balance the energy mix.

However, a bet on LNG is somewhat unlikely to play a role. The EU has a poorly developed network of pipelines between the countries, the so-called interconnectors, which transport gas from offshore liquefaction terminals inland.

Moreover, even if the proper infrastructure took place, there is no common energy policy that would help redistribute the gas flows within the area. For instance, stocked up with gas for the winter, Poland refused to share it with its neighbours and demanded Norway make its producers sell it at half a price. The kingdom declined it – the market is the market.

If we make simple calculations and add up all the gas purchased by individual EU members and then divide it among all, it would still be insufficient. Firstly, the EU is a net importer of energy resources and has almost no own resource base. For instance, the largest field Groningen, where the EU extracted most of its gas, is depleted and decommissioned.

Secondly, around 40% of the gas was imported to Europe from Russia. Due to the crisis with the eastern neighbour and the fall-out of the volumes, it is a challenge beyond compare to come up with a supplier to replace Russia overnight.

You make your own luck

The energy crisis could not have occurred as "a bolt from the blue". In fact, a whole chain of events led to these unthinkable gas prices.

The transition from oil-linked long-term contracts to purchases in the spot market: the suppliers were expected to dump gas prices by offering better terms. Consequently, it turned out the opposite: betting on spot purchases, the EU found itself on the market, which led to competing with the high-end Asian markets. This competition heats the gas price substantially.

The accelerated filling of storage facilities. The EU states plan to fill their storage facilities 90% before winter, while the gas traders use this as an opportunity to brazenly jack up prices.

Gazprom has already left just 20% of Nord Stream's capacity and promises to shut it down soon, either because of unscheduled maintenance or for some other obvious reason.

Photo: Reuters

The member countries' governments are willing to subsidise gas purchases, hence the EU can afford to buy gas at higher prices. And the present gas rush will continue until the bloc manages to fill its storage facilities. Prices may drop by a few thousand later but not to pre-crisis levels. Yet, the market will remain highly volatile.

Gray energy transition

All the more reason is the infamous green transition. Whereby there has been much talk and little action.

LNG producers might have been bolder to invest in production and transportation if the EU had not discussed decreasing its natural gas demand for years. The European Union has acted in the opposite direction: it has persuaded gas producers not to increase production and to construct pipelines or liquefaction plants, claiming that it would not prove beneficial.

If only the issue were the gas price, the solution would have been found. Eurocrats would tighten their belts and buy as much energy as needed.

However, according to experts, there is not enough gas in the world. Europe may have already pumped all it could, and there is a fierce fight for the remainder. Hence, the price skyrocketed to USD 3,500 per 1,000 cubic meters. And it is poised to rise.

Across the ocean news does not add optimism either: Freeport LNG delayed its facility restart until late 2022 after a fire in June. As a result, it is unlikely that the US can increase gas supplies soon.

Instead, coal export from the United States to Europe has increased by more than 140% year-on-year. This is an energy transition to gray resources rather than long-awaited and longed-for renewables.

Thus, Germany is restarting its coal-fired power plants. And again, coal supplies haven't been without challenges: the current shallow water levels in the Rhine River make it more difficult for barges to carry heavy loads down the river.

Crisis is creeping

In France and Germany, electricity prices have risen 10 times since the last year. Futures for next year's supply reached EUR 1,000 per 1,000 MWh in the Fifth Republic, and a similar contract costs more than EUR 800 in Germany.

France found itself in a more challenging situation, as it has heavily relied on nuclear power, while half of its nuclear power plants shut down for planned maintenance.

In Britain, from October 1, the cap on the acceptable price of electricity will rise by 80% at once. London Mayor Sadiq Khan, who has been scoring political points on gloomy predictions of late, said if the government does nothing, Britain's cost-of-living crisis would be a national disaster.

Energy prices are driving up inflation, which amounts to 9% in the Eurozone. The rising gas costs are making production more expensive. Particularly, a crisis is brewing in the agrochemical sector now.

Europe has already lost about 25% of its nitrogen fertiliser capacity. Some companies, such as Norway's Yara, have slashed production to 35%. At current gas price level, fertilisers are so expensive that farmers prefer to rely on the forces of nature. Amid unprecedented drought their last hopes for a good harvest were shattered. It will undoubtedly impact global food prices.

In the EU, de-industrialisation is now in full swing, while the European living standards, a model of comfort and prosperity for the rest of the world, are falling. For instance, one in four people in Britain admit they will not heat their houses in winter due to high prices. One in ten, however, will take out a loan to pay for home heating.

Is Europe becoming an energy-deficient region?

Amid this backdrop, the US Secretary of Energy Jennifer Granholm’s words seem utterly mocking. She advised Europe to develop "green energy" so that it could grow independent of hydrocarbons.

However, if the European Union shuts down its production facilities amid the crisis, this dependence will also be reduced. And if the population shrinks as well, then the transition to carbon neutrality will happen even faster.

This article begins with gloomy prophecies – so shall it be in the end.

Recently, Elon Musk said he fears civilisation will crumble without oil and gas. He believes you won't get far on renewable energy sources. They can surely be enough to push things way too far, right up to the end of civilisation.

We will check it out on Europe.