This message is about the creation of a joint Russian-Indian independent tanker fleet. The emergence of such a structure, independent of international insurers and relying on its infrastructure, means a fundamental step in moving away from the global dollar (Bretton Woods) system.

Of course, the result of this work still needs to be discovered, but the policy of the West makes it almost inevitable: there is a need for this initiative, but it is impossible to prevent it. It was just a matter of someone taking the initiative, and it happened. It should be noted that over time there will be more and more "self-fulfilling" initiatives to create alternative economic institutions to Bretton Woods.

Another step towards the destruction of the authority of the dollar was the last-minute permission to confiscate Russian assets arrested under sanctions (contradicting international law and the Bretton Woods principles) in the US budget at the last moment. No one had any illusions about this, but the inclusion of the corresponding clause in US law means that the "security" of the world dollar system has even officially become fiction. This event's consequences will manifest for many more years, and it is already impossible to restore trust.

Moreover, adopting such a decision means that the tactical problems of the US financial system begin to prevail over the task of maintaining the stability of the global dollar system. Corresponding signals have been around for a long time, but it became apparent after the decision was made. And this means that it is not so much "the firm determination of the United States to punish the aggressor" as a transparent process of growing severe problems.

Macroeconomics

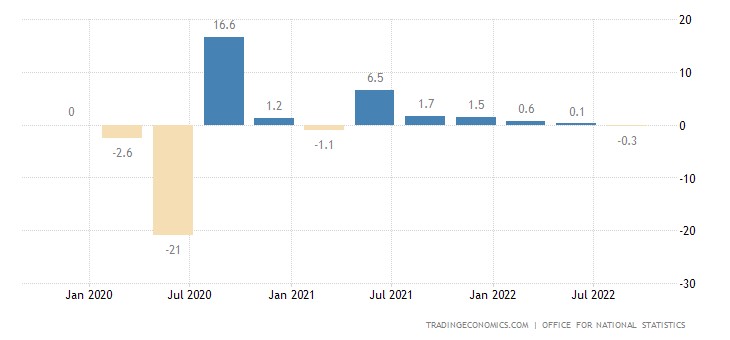

In the 3rd quarter of UK GDP -0.3% per quarter:

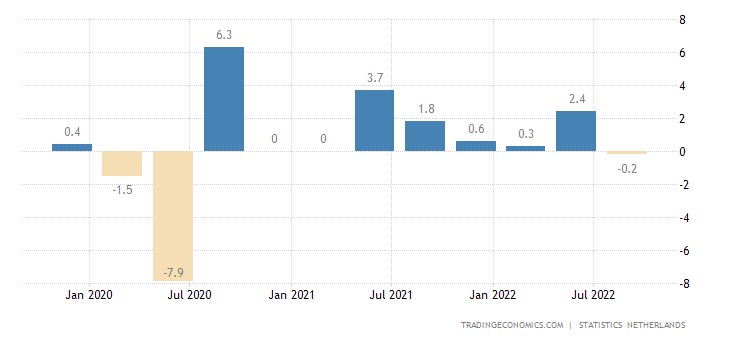

In the Netherlands -0.2% per quarter:

The balance of industrial orders in Britain keeps in the red for 5 months in a row:

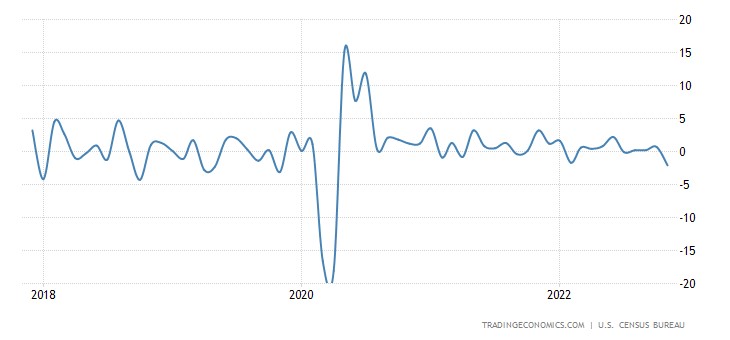

US durable goods orders -2.1% m/m: worst performance in 2.5 years:

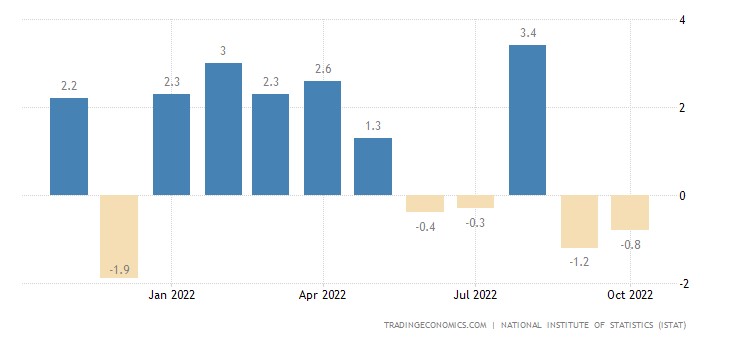

Sales of industrial products in Italy -0.8% m/m – 2nd negative in a row and 4th in the last 5 months:

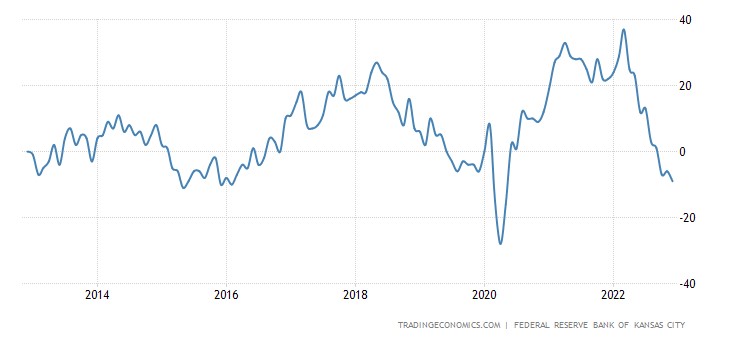

The Kansas Fed Regional Activity Index is in the red for the 3rd month in a row, without the failure of 2020 it is at the bottom in 7 years:

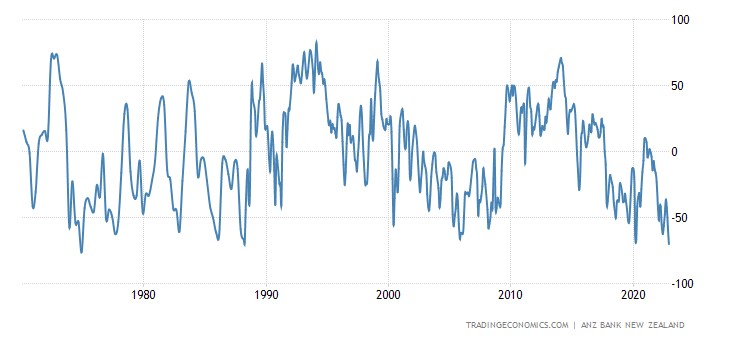

New Zealand business is gloomy at its highest in 48 years:

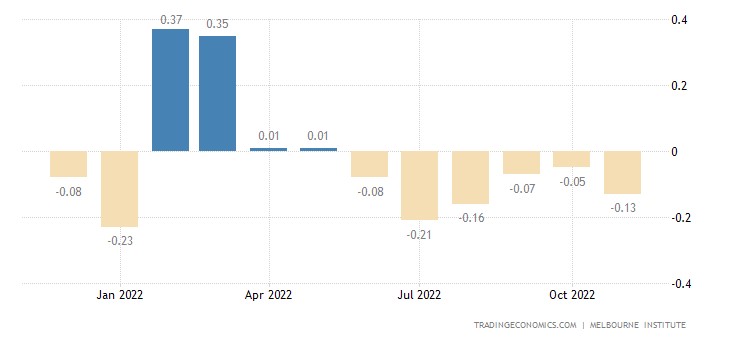

Australian leading indicators worsen for 6 months in a row:

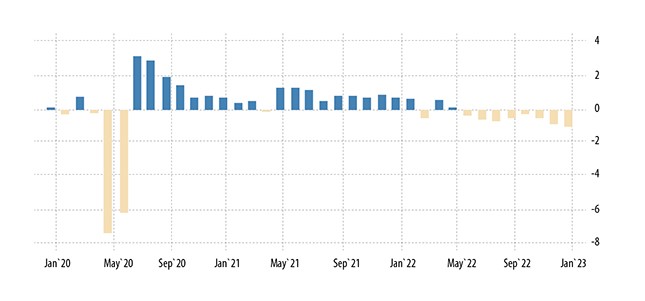

And in the USA – 8 months in a row, and the last negative (-1.0% per month) is the worst in 2.5 years:

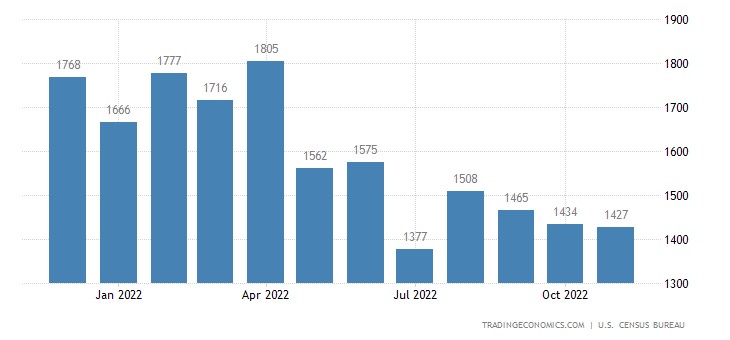

The number of new buildings in the US -0.5% per month – the 3rd negative in a row:

Building permits -11.2% per month, the worst in 2.5 years and generally already at the levels of 2016:

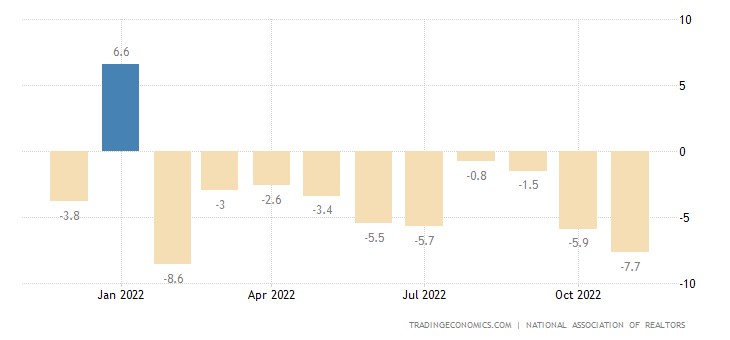

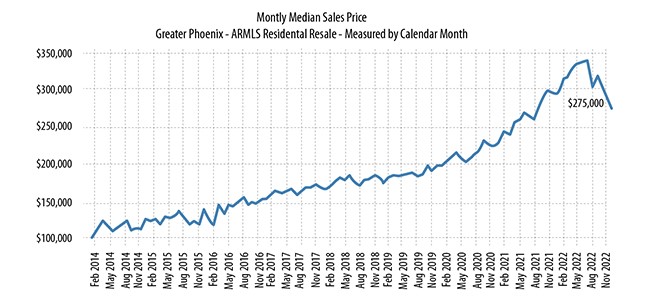

US existing home sales -7.7% m/m – 10th straight loss:

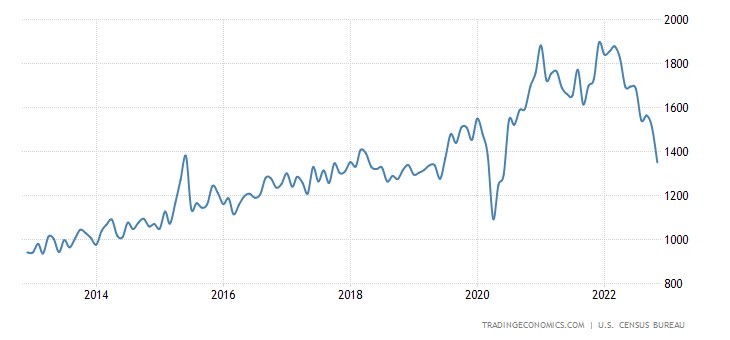

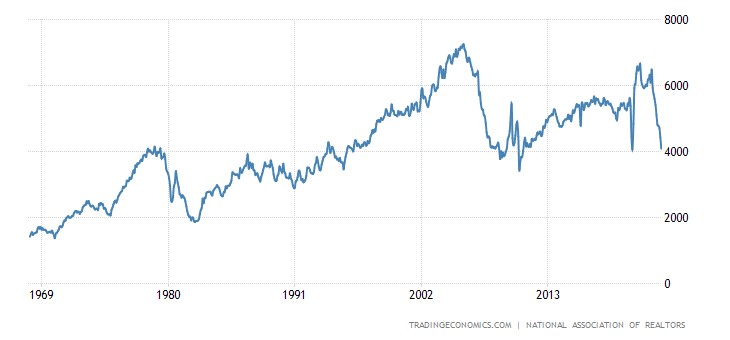

They fell to the bottom of 2020 and 2008/10, and previously such levels were only in the 1st half of the 1990s:

The U.S. housing market index is only 1 point from the bottom of 2020, and without it, this is a 10-year low:

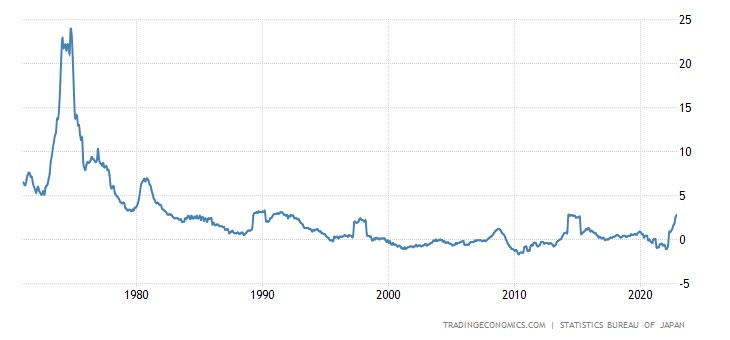

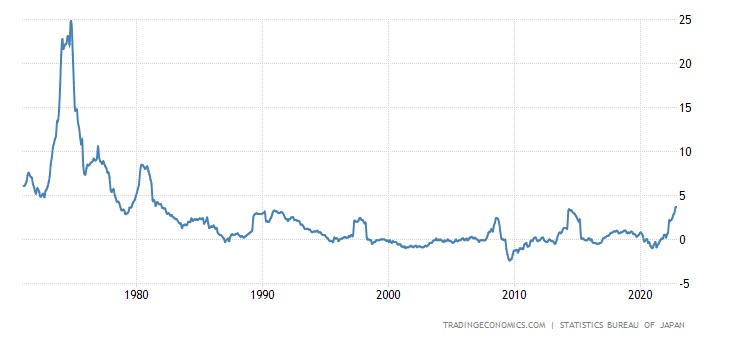

CPI (Consumer Inflation Index) Japan +3.8% per year – the highest since 1991:

31-year top and inflation without food and fuel (+2.8% per year):

And CPI excluding fresh food at its peak since 1981 (+3.7% per year):

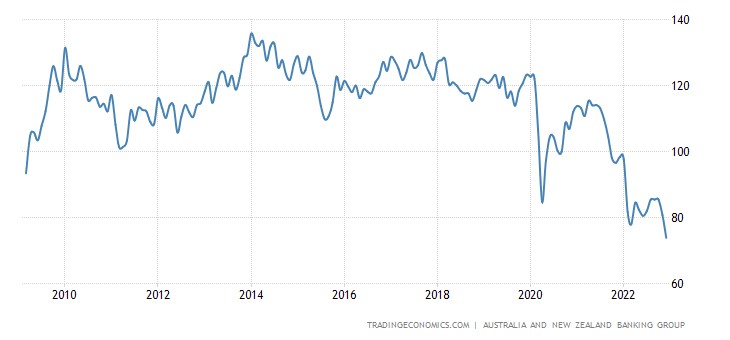

New Zealanders are record pessimistic:

The Central Bank of Indonesia raised the rate by 0.25% to 5.50%. The Central Bank of Japan left rates in place but increased the allowable interest on government bonds and their buying.

The Central Bank of Turkey did not change anything, as did the Central Bank of China, which left the monetary policy unchanged.

Main conclusions

Near at hand – Christmas and New Year holidays, little news. But those that do exist – show the continuation of the structural crisis. Once again, we repeat the basic difference between a structural crisis and a collapse in financial markets: it develops consistently and evenly, without jerks and stops. This is precisely what we have seen in recent months.

At the same time, the main direction of the decline may change. Let's look at the real estate price chart. The recession began only in June; there was no crisis before that. However, the graph of prices for industrial products shows that it was in June that industrial inflation peaked at 23.4% year on year. In other words, the crisis manifested primarily in rising prices at the beginning of the summer of the outgoing year. The Fed's policy decreased inflation, but degradation processes began in the real sector.

At the same time, lowering inflation has not gone away (it is systematically built into the statistical methodology), so the decline in US GDP continued all these months. The experience of 1930-32, when the United States had a "clean", that is, practically undisguised structural crisis, shows that the rate of decline in it was about 1% of GDP per month (or about 10% of GDP per year). Accordingly, for almost three years of the crisis, the cumulative decline amounted to about a third of GDP.

Based on this analogy and considering the scale of underestimation of inflation and active anti-crisis policy, the decline in US GDP by the end of this year will be around 7-8%. Similar processes are taking place in other regions, including the European Union. Observers say that they do not notice a drop in the pre-holiday activity of the population. Well, the fact that European states are trying to compensate households for rising costs leads to other problems:

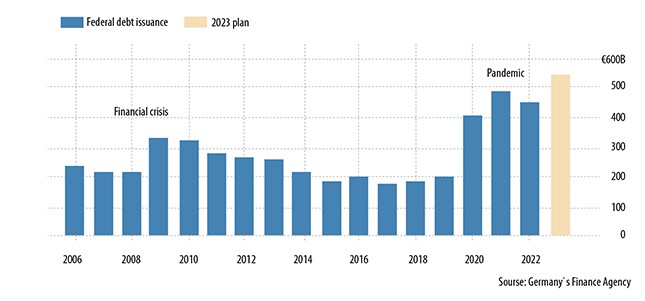

The growth of Germany's debt has already exceeded the covid indicators, and there is no doubt that this cannot continue for a long time. Based on the scale of structural distortions in the economy, the scale of the crisis is one and a half to two times higher than similar events in 1930-32. The crisis that began in the fall of 2021 may last another 5-6 years, given its slightly slower speed in the face of active opposition from state structures. Given the decline in market capacity (the reduction in export earnings), the German authorities will be forced to reduce support for households – with all the ensuing consequences.

Roughly speaking, so far, we have passed about 20% of the maximum scale of the crisis, and in some areas (for example, a drop in household demand), this figure is even less. So the dubious pleasure of living in a crisis, we still have a long time.